This is the first of three Insights in which we’ll reveal the biggest secret in personal finance – how to design a great financial plan.

Later in this series, we’ll outline the (widely agreed) financial planning process in seven (A.W.E.S.O.M.E.) steps that you can use regardless of your age, income, wealth or wherever you live in the world.

So, feel free to share this series of Insights with your family and friends – it’s designed to help everyone.

What’s Coming Up?

In this first Insight, we’ll explore why financial planning is so secret – and the personal financial crises that arise because of what people do instead.

In the second Insight, we’ll explain what financial planning really means, why it’s the best way to manage our money – and cover the first of seven steps in the AWESOME financial planning process.

Then in the third insight we’ll complete our outline of this process – so you can start to plan your money on your own or, as we suggest, with help from a professional adviser.

If you’re unsure if it’s worth paying for advice or want to know where to find sound sources of FREE advice – read our Insight here.

Want to skip to the end – and grab the AWESOME process?

Well, you could do that, but you’ll probably enjoy this series more (and retain more of the ideas) if you first learn why financial planning is valuable.

The truth is that most people avoid talking about money matters – and we listed ten reasons for this here.

However, we know from Psychologists that having no knowledge or skills in a subject can be an enormous barrier to engagement.

And this is good news as it means we avoid driving cars on the road – until we’ve had some lessons!

Of course, we may feel much less motivated to learn to manage our money – than to drive a car.

And we suspect many people avoid learning about money for the same reason we all avoided some subjects at school.

The teacher wasn’t engaging or fun – and we saw no use for the subject.

So, we want to make this learning fun – and we’re keen to start with the WHY questions.

We also believe some schools could do more to answer the question of ‘why learn this’—don’t you?

OK, but is financial planning really a secret?

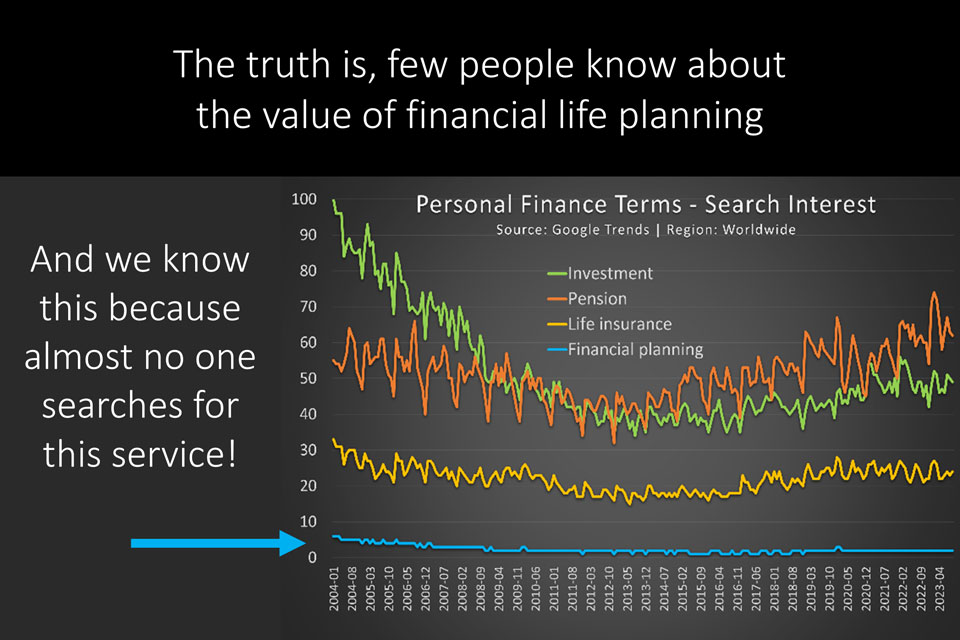

Yes, it is a secret to most people worldwide – and the evidence is here.

This chart shows global search trends, but the picture is similar for the UK and USA in isolation.

(The search numbers for ‘Financial Advice’ are also flatlining at the bottom of that chart)

In short, many more people search for financial products than seek advice on the products they need.

And we want to change this picture – by helping more people choose the right boxes and investments for their money – which requires us to decide first what we want to do with our money and when.

That is the gist of financial planning.

It’s about connecting your money to what really matters in your life.

Why has no one told you this before?

That’s a good question – and there are at least four causes of this financial literacy problem.

First, our schools don’t all prioritise the numeracy skills we need to answer personal finance questions.

So, very few people can estimate:

- The size of the pension fund they’ll need for the pension income they want.

- The future value (in today’s money terms) of lump sums (or regular savings) invested over time.

To answer these questions, you must know which formulae to use in a spreadsheet.

Or which online calculators are accurate and use sensible assumptions.

And please be aware – not all of them do!

Second, we struggle with money questions because the basics are not consistently taught in schools.

Yes, some basic money management skills are taught in some schools today.

But in the UK, it’s a postcode lottery as to what children are taught – and, sadly, the proportion of children taught anything about money is falling.

In addition, we know that longer-term financial planning topics are rarely taught at all in schools or (incredibly) within business or economics degree courses!

So, is it any surprise that most people know little about pensions?

The third significant cause of confusion around money is Government policy.

Governments define the taxation and other features of financial products and strategies, including:

• Whether we enjoy an uplift on our money – as tax relief or a government bonus.

• The limits on the amounts of money we can put into different money boxes.

• The limits on when we can access that money – and how much of it is tax (or penalty) free.

The constant tinkering (by all governments) with the tax rules makes it extremely hard to make sound financial decisions.

So, we offer this other series of Insights to help you grasp this product comparison task.

Just be sure to seek competent advice before you invest your money. Even the rich and famous fall for SCAMS and Ponzi schemes, and we don’t want this to happen to you.

An extra warning about #finfluencers

We urge you to avoid investing tips from random (unqualified) #finfluencers on social media.

The UK’s financial regulator now has rules about financial promotions on social media and is finally bringing criminal charges against those who mislead us.

And research from the Swiss Finance Institute (based on data from 29,000 Twitter (X) accounts) showed that over half (56%) of ‘influencers’ give money-losing tips – while another 16% provide no value at all.

However, the most shocking fact is that the money-losing tipsters tend to have the most followers!

Could that be because the noisiest people on Social Media are the most (over) confident?

Well, Psychologists have also shown that we humans tend to obey instructions (without question) from those we see as authority figures.

We don’t take enough care to check the credentials of these confidence tricksters.

For information: If you’d followed the tips of the majority (money-losing) tipsters – you’d have lost 2.3% on average – each month!

Click here to learn how to choose money boxes.

Finally, regarding what turns people off personal finance, we think some product providers (banks, insurers, fund managers, pension providers, etc.) make the topics too complicated.

These firms need to work harder to offer more engaging, plain English answers to crucial money questions – and, in fairness, the leaders are now improving their content.

Either way – that’s our mission – to bring accurate, balanced and compelling money Insights to you.

If people don’t plan their money, what do they do instead?

Unfortunately, many people don’t seek financial guidance until events overtake them – and then rely on friends, family, and social media influencers for ideas.

Of course, some of those people are well-intentioned, and some may be experts in personal finance matters.

In many instances, however, the quality (and personalisation) of their advice will not match that of a qualified financial planner.

Few people take financial planning seriously until they (or someone they know) encounter a financially challenging life event. And it’s worth thinking about those events in advance.

So, here are 15 of those events, which we’ve (arbitrarily) divided into five categories – to make the list easier to read.

Life and Death events

• A sudden illness or death of someone close may prompt you to review your life and health insurance needs. If you have loved ones who depend on you financially or you’re the primary carer of your children, you’ll want to cover these risks.

• Such events are, of course, more common in later life and may remind you of the need to set up a will and lasting power of attorney.

• You may want to explore ways to boost your income or leave a financial legacy to the people and causes you care about – or save inheritance tax.

• And you may discover that making gifts during your lifetime will save your family more tax – and give you more joy in seeing others benefit – in your lifetime.

Financial windfalls

• If you receive a large sum of money—from a life policy, inheritance, business sale, or lottery win—you’ll likely want advice on investing.

Homebuying and Mortgage events

• Various challenges under this heading will trigger financial questions, like when:

• You buy a first (or larger or second) home.

• You have a fixed-rate mortgage, which expires soon.

• You have an interest-only mortgage nearing the end of its term.

• And, if you’re earning enough money to overpay your mortgage, you may want advice on whether it makes sense to do that – or invest your surplus income elsewhere.

Relationship events!

• If you start sharing a home with your partner, you’ll want to agree on a fair share of living costs.

• And, at some point, you may wish to plan together to achieve some longer-term financial goals.

• If you have children, you’ll want to review your (and your partner’s) life and ill-health insurance – and your longer-term savings needs – to help a child through University, for example.

• If you’re considering a divorce or separation, you’ll want a clear picture of your finances and how they might change after you separate. And you’ll want to make a will – or amend the one you have.

• If you find a new life partner, you’ll want to reset your financial goals at that time, too.

Events around work – and pensions

• If you start a job where your employer offers a choice between two workplace pensions, you may want guidance to choose the right one for you at that time.

• A promotion at work (or pay award) will get you thinking about how best to use that extra income.

• If you have several pension pots (from different jobs), you may wish to combine them into one plan to make your funds easier to administer – or for other reasons.

• If you’re a business owner, you may want advice to ensure:

• You enjoy a tax-efficient share of your business profits – now and in retirement.

• Your loved ones don’t lose out if you become seriously ill or die unexpectedly.

• For many people today, retirement is not the ‘full stop’ event it once was. However, as you approach your later years, you’ll want a plan for generating an income (from your pension, any other investments and perhaps part-time work) so you’ll have enough to last for life.

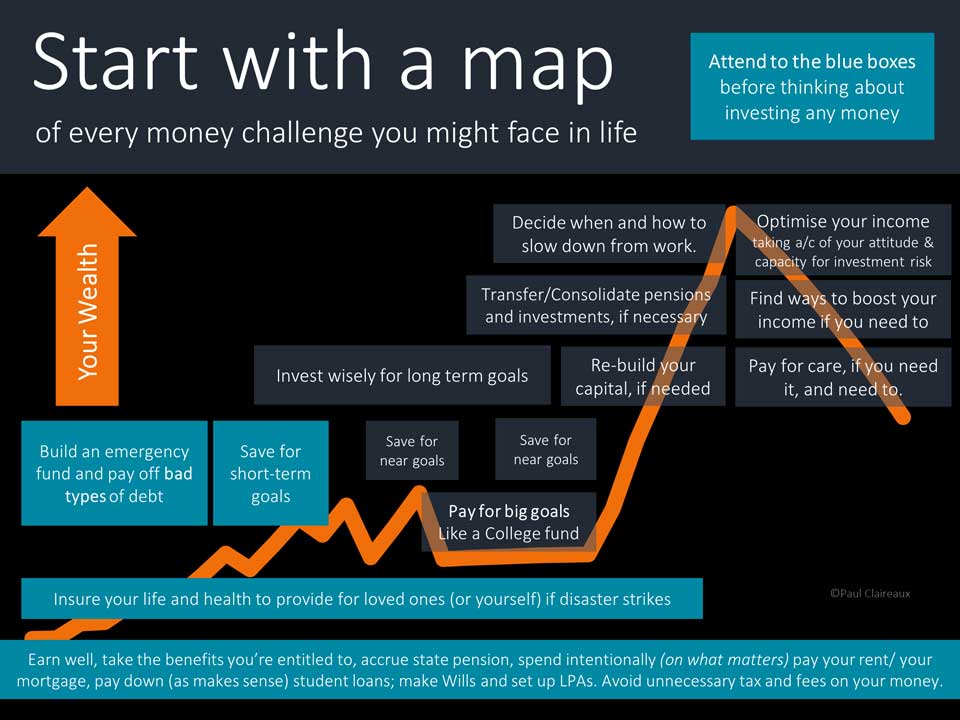

So, many events could trigger your interest in financial planning – and you may find it helpful to save this map (of the likely financial challenges in your life) for future reference.

Just note that you may not have to deal with all these challenges.

What’s wrong with reacting to events?

No one would suggest you plan for all those events at once.

(You’d not usually plan for a divorce while planning to get married!)

However, you’ll want to plan to meet your short, medium and long-term financial goals – and insure against the near-term risks (however slim) to your life and health.

To be blunt… it’s too late to insure the life of the primary breadwinner (or the child carer/homemaker) in your family – after they’ve died from a sudden accident or illness.

And it may be expensive (or impossible) to find comprehensive life (or health) insurance after you’ve been taken seriously ill.

So, if you can, please sort out those personal insurance needs while in good health.

Doing so could save you a fortune in insurance premiums. And you may be surprised to learn that taking advice in this area might save you money, too!

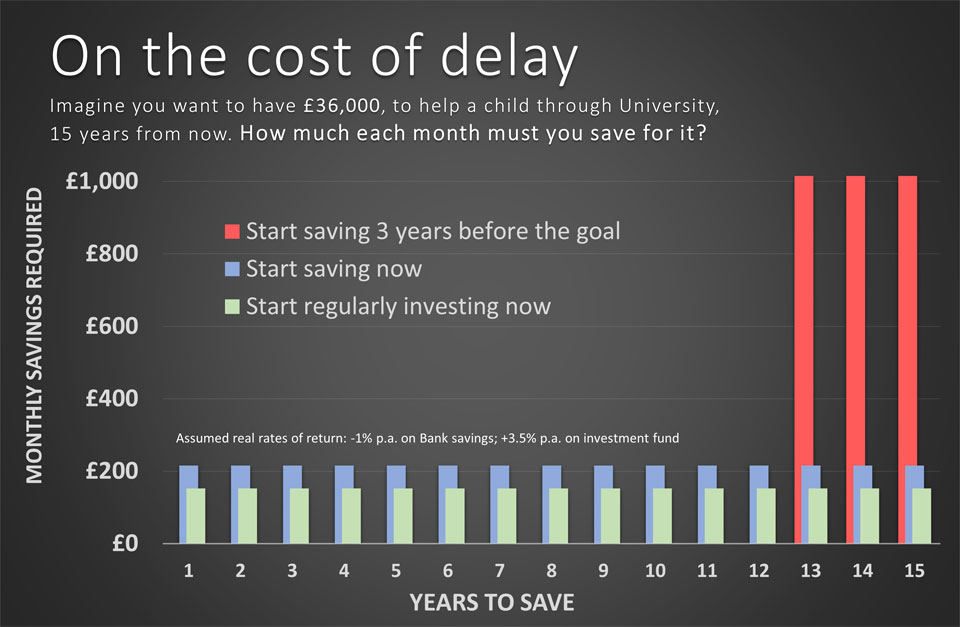

Likewise, it’s too late to start a long-term savings plan when the event you’re saving for is only a short time away.

Reaching your (original) financial goal can become impossible if you delay starting your savings.

For a goal like helping a child through school or University—you don’t have the option to extend the end date for your savings!

So, please remember this picture of the ‘cost of delay’ – when you think you should start saving for your important long-term goals.

There is no time like the present to plan these numbers.

Of course, you probably know this simple truth about money, but we think it’s worth repeating.

Starting your savings early makes is substantially easier to achieve your goals.

Coming next

Of course, sound financial planning isn’t quite this simple – and it’s certainly not common sense – as we showed here.

So, in the next insight we’ll explain more about what financial planning means, and why it’s so important to follow this approach.

And we’ll start to outline a seven steps (A.W.E.S.O.M.E.) process for planning your money.

See you in there when you’re ready for that.