A 10 to 15-minute read – depending on your speed.

By the end of this ‘About Money’ article (for investors of all ages), you’ll understand more than most people about this critically important paradox of investing.

In short, you’ll know why stock market crashes can (simultaneously) be good news for some people and miserable for others!

We know that sounds impossible, but it’s what sometimes happens in the real world.

So, it’s essential to understand this, and the thought experiments here are the safest way to learn.

Imagine three different Investors.

Robert, Grace and Ian are three fictional investors whose experiences we’ll explore:

• Robert was thirty-five when he started regularly investing £2,000 a year to build a fund to help his child through college.

• Grace was thirty-nine when she invested a lump sum of £20,000 for growth towards a college-fund goal for her children.

• Ian was approaching retirement and, among other investments, had a pension fund worth £100,000 – from which he withdrew a level income of £7,200 each year.

These three investors put money into the same investment fund for ten years and were surprised (or shocked) by their different investment outcomes.

We’ll explain why, but first, we must say something about their investment fund.

Our fictional investors all chose the same fund.

The best way to illustrate this paradox is to keep things simple. So, we’ll assume that all three of our investors put their money into the same (stockmarket-based) fund – one that invests in the shares of a wide range of companies from many industry sectors in countries worldwide.

This investment fund could have been a world index tracker or an actively managed fund – that detail does not matter for understanding this concept.

We only need to assume that the Investment fund behaves like most well-diversified stock market funds.

So, the fund price might rise or fall (by a lot) in the short term but would likely* deliver returns ahead of savings accounts over ten years or more.

To be clear, we don’t suggest that each of these investors should invest in the same type of fund.

As we’ve explained in another series of ‘About Money’ articless, you need to consider four factors to decide on the right level of investment risk for each of your financial goals.

Here, we’re simply pointing out the paradox of investing for different needs during periods that include extreme stock market price movements—either up or down.

A warning about our example returns

Our example (ten-year) average return of 7.2% p.a. is provided purely for educational purposes.

We’ve chosen this number because it’s a reasonable (nominal, net-of-charges) rate of return to assume when compared to historical averages.

Let’s be clear, however, this is not a forecast of future returns.

When investing, you must always read this warning and take professional guidance or advice when you can.

Past performance is no guide to future returns. The value of investments and the income from them can go down as well as up. You could get back less than you invested. All investments should be regarded with a long-term view.

Also note that in the examples below, the returns:

• Are not adjusted for inflation.

• Take no account of taxes – which would not apply to investments held in tax-free financial products, in any event.

• Are assumed to be net of all charges (for the financial product, investment fund management and any advice).

Ask your financial adviser (or product provider) for illustrations of potential returns on any specific investment-based product you’re considering or currently holding.

Now, let’s look at our two scenarios.

Imagine two paths for the price of the Investment fund.

Here, we will explore how our three investors’ emotions might differ depending on their invested funds’ price path – up and down.

Of course, the fund price could follow any one of millions of paths over ten years. If we used a stochastic modelling tool, we could show how many other price paths might affect the investment returns experienced by each investor.

However, if we go there, we’re at risk of disappearing down a rabbit hole of complexity. So, to help you grasp this concept, we’ll start by exploring just two very different scenarios.

Scenario 1 – Boom and slow growth.

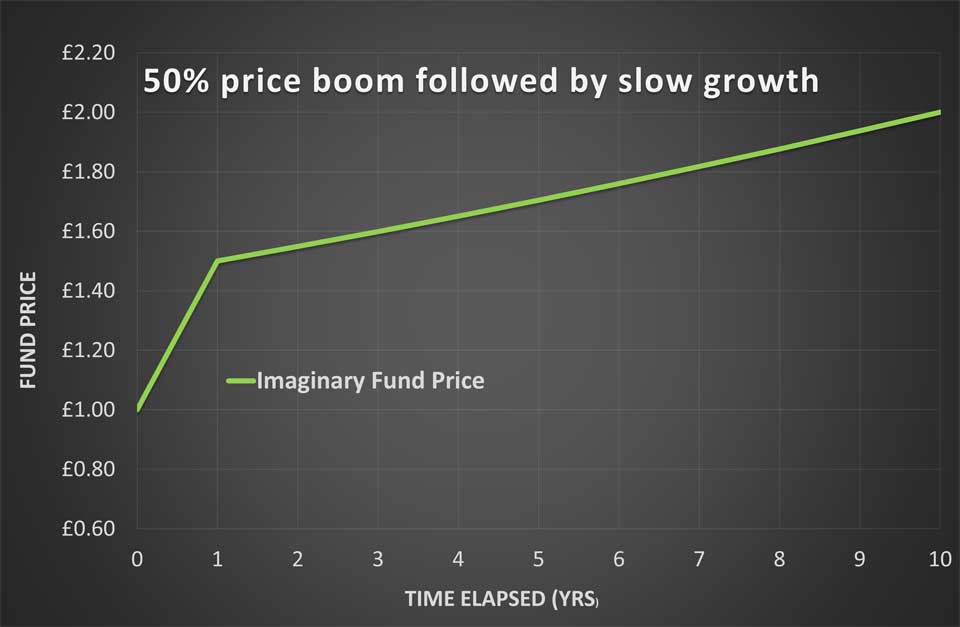

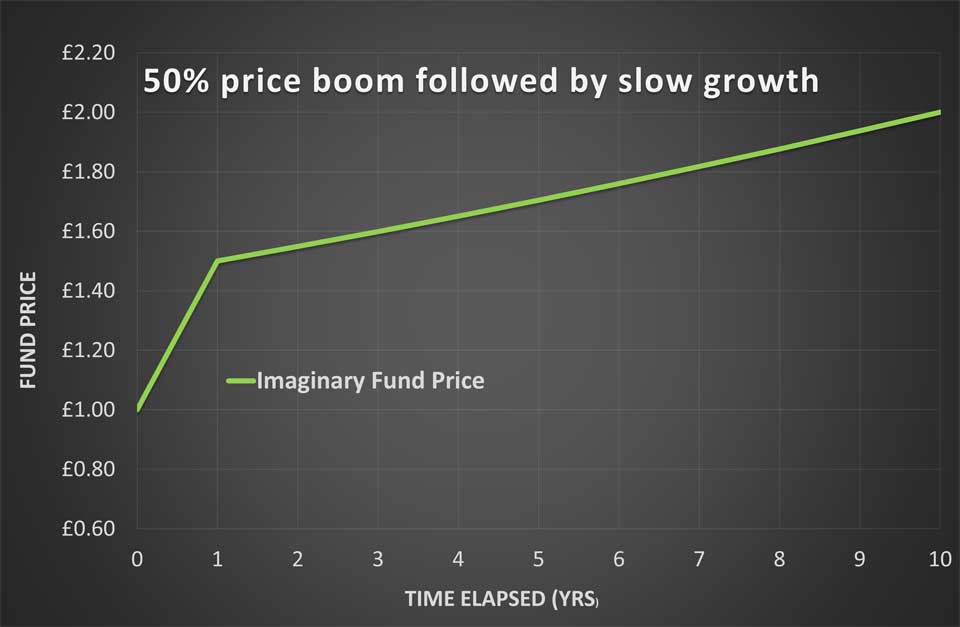

For this scenario, we’ll imagine the investment fund price initially rises, like a rocket ship, by 50% in the first year.

Then, after the boom, we’ll assume the fund price continues to grow but at a slower pace of around 3% a year for the following nine years.

This price path delivers an average return of 7.2% p.a. over ten years – and that growth rate (as you’ll know if you’re familiar with the ‘rule of 72′) will double the fund price from £1 to £2 per share over ten years.

So, our ‘Boom and slow growth’ scenario would look like this:

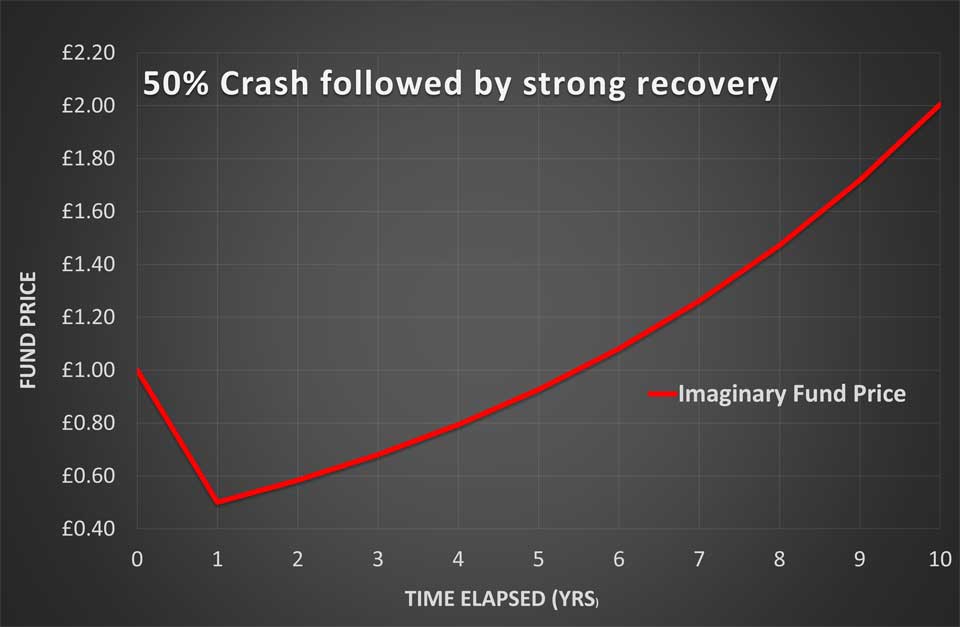

Scenario 2 – Crash and strong recovery

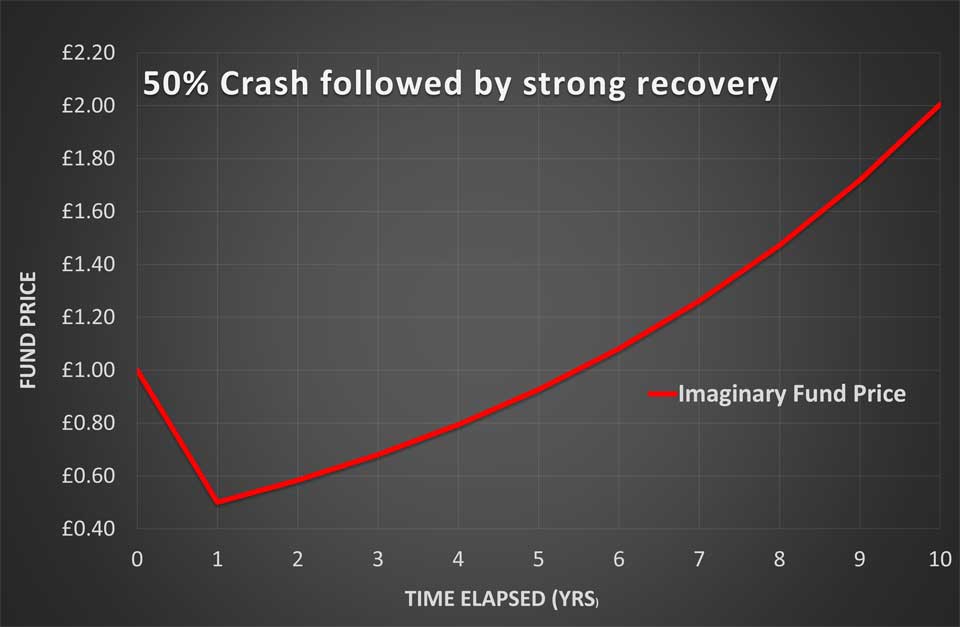

For our second scenario, we’ll imagine the fund price crashes by 50% in the first year, and then recovers strongly – to grow at nearly 17% p.a. over the following nine years.

Our ‘Crash and Strong Recovery’ scenario looks like this:

This price path also equates to an average annual return of 7.2% after charges.

So, as in the previous scenario, the fund price would double over ten years.

Aren’t these just simplified scenarios?

Yes, they are – and we’ve deliberately ignored the likely small and regular gyrations in the fund price to keep these examples simple.

Small daily fund-price wobbles don’t significantly affect your investment outcome compared to the significant price shifts in our examples.

Also, while these are extreme examples, they’re not unrealistic. Even globally diversified stock market-based funds experienced two big falls (of 40 per cent and 30 per cent) in recent decades. Just remember that such stock market-based funds also deliver better returns than cash deposits over most 10-year periods.

Who might be happy (or upset) in these scenarios?

To be clear, we’d never suggest that anyone would be happy with the extremely difficult times that may be associated with a serious stock-market crash.

The dot.com crash in the stock market (between 2000 and 2003) was different in this regard, but crashes are often associated with widespread job losses, wages failing to keep up with inflation, falling home prices, and high-interest rates on mortgages and other loans.

Grace’s experience if a recession had forced her to encash her investments early (or Robert’s if he were unable to continue paying into his regular investment plan) would be very different from what we show here.

Therefore, we assume that each of our three imaginary investors did the wise thing and built a substantial fund of accessible bank deposits to use in an economic or other emergency (like needing to pay for substantial repairs to their home or car) before they started investing.

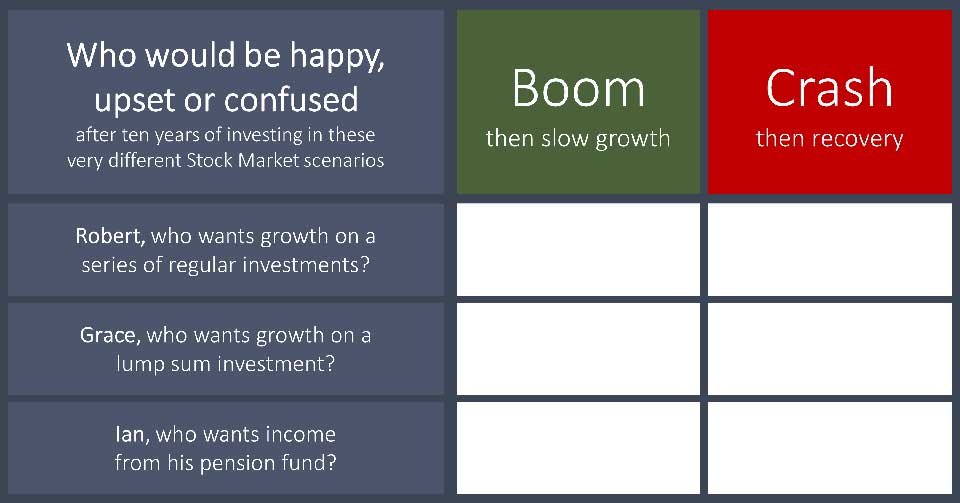

In this ‘About Money’ article, we want to explore how each of our investors might feel during our two very different scenarios. And, before reading further, jot down how you think they would feel – on a table like this.

Who would feel happy, upset, confused or indifferent about their investments in the two scenarios shown?

Here’s how we know this plays out.

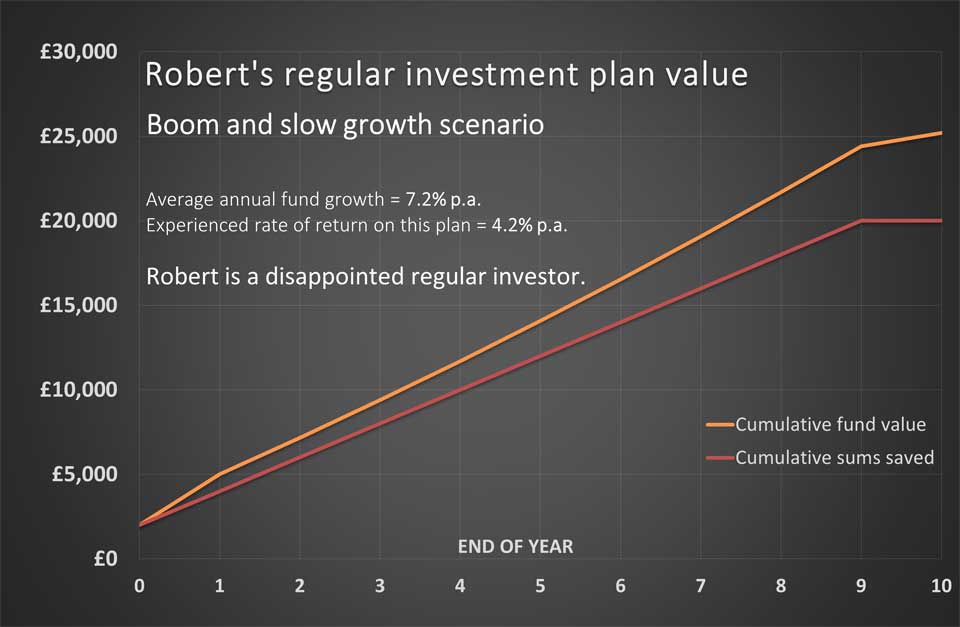

First, in a boom and slow growth scenario:

Robert (our regular investor) would initially be elated as he sees his first year’s investment grow in value by 50%.

However, over time, he may become frustrated by the slow growth of his accumulated funds. And, after ten years, his effective rate of return on all his regular investments would be just 4.2% p.a. So, while Robert would have made a positive return, his accumulated fund after ten years won’t be much more than he paid in.

And, after such a great start, he might reasonably wonder what went wrong with his investment plan. Of course, nothing went wrong with his investment fund. It’s just that after the first year, Robert’s subsequent investments only grew at 3% p.a.

Here’s how his fund values would have grown over time.

Grace (who invested a lump sum for growth) would be thrilled initially, as she would see her entire investment grow by 50% in the first year. And she, too, might be slightly disappointed at the reduced pace of fund growth in subsequent years.

However, Grace would have good reason to be happy both throughout the journey and at the end of 10 years. After all, she would not have endured the pain of any falls in her fund values and would have enjoyed an average return of 7.2% p.a. on her money.

This is the same return as that on the fund.

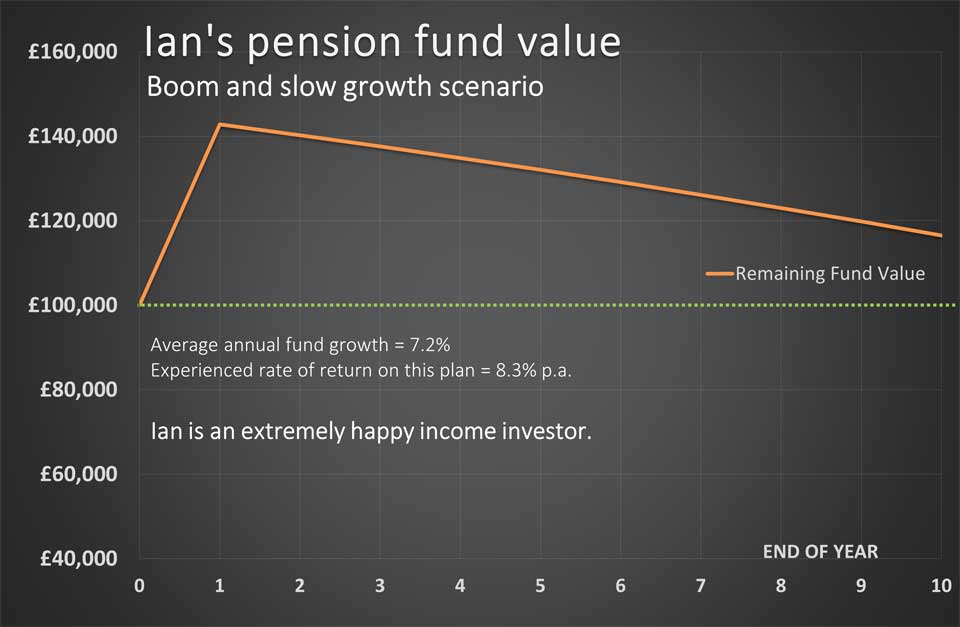

As for Ian, our Income investor, we believe he’d be delighted in this scenario, and here’s why.

Ian might have expected the original value of his pension fund (of £100,000) to be preserved. Remember, at the end of each year, he withdrew 7.2% of his original pension fund for income, and his investment fund price grew (on average) at the same (7.2%) rate (after charges) each year. Yet, Ian’s pension fund would be valued at £116,500 after ten years.

That’s nearly 17% more than he expected!

And, taking account of his withdrawals, Ian’s experienced rate of return on his pension plan would have been 8.3% p.a.

So, a boom and slow growth scenario might feel like magic for an income investor like Ian!

Here’s how Ian’s fund values would look over our ten-year period.

Note how the initial 50% boost to Ian’s fund left him with more than £140,000 after his first income withdrawal of £7,200.

That initial boost to his fund made Ian’s (fixed) income withdrawals sustainable – despite only modest fund growth after the first year.

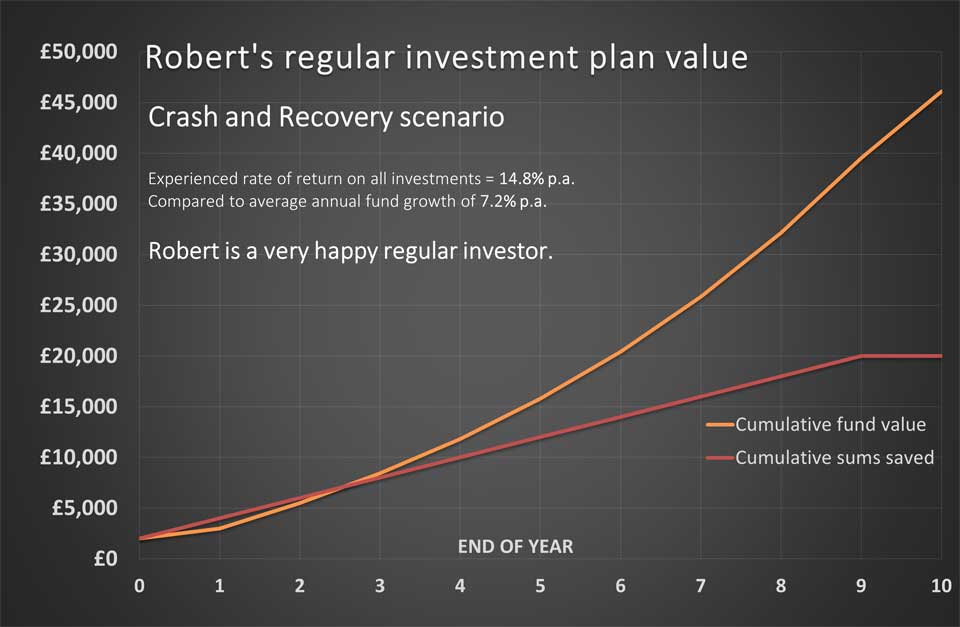

What about the crash and recovery scenario?

So, in our second (crash and recovery) scenario, Robert (our regular investor) may be unhappy, initially, to see the value of his first year’s investment down by 50%. Over time, however, Robert would be much happier about his returns.

(This assumes he was able to continue making regular investments during what would likely be a challenging time for the economy.)

After ten years, Robert would be delighted to learn that his overall rate of return on all his investments was nearly 15% p.a.

Fifteen per cent annual returns!

Yes, that may sound incredible, given that the fund price only grew at an average rate of 7.2% p.a. over the whole period – but it’s simple to explain.

Nine out of ten of Robert’s regular investments would have benefited from the recovery period’s stellar returns of c. 17% p.a.

And, here’s how his fund values would have grown over time.

Grace (our growth investor) might be even less happy than Robert after the first year, given that her entire investment of £20,000 would have fallen in value by 50%.

Please note that this sort of crash in stock market prices can cause severe stress for many people. And some will decide to take their money out of investments after the crash.

So, as well as considering your capacity to take investment risks, you need to consider your attitude to investment risk – also called your investment risk tolerance. In short, before you invest, learn about your temperament – and think about how calm you could remain during a stock market crash.

It’s best to take advice on this matter.

Assuming Grace had been well advised and could hold onto her investments in this scenario, she too would end up happy, having doubled her money over the ten years.

As before, Grace’s experienced return on her investment would have been the same as the average (7.2%) annual return on the fund.

What about Ian, our income investor?

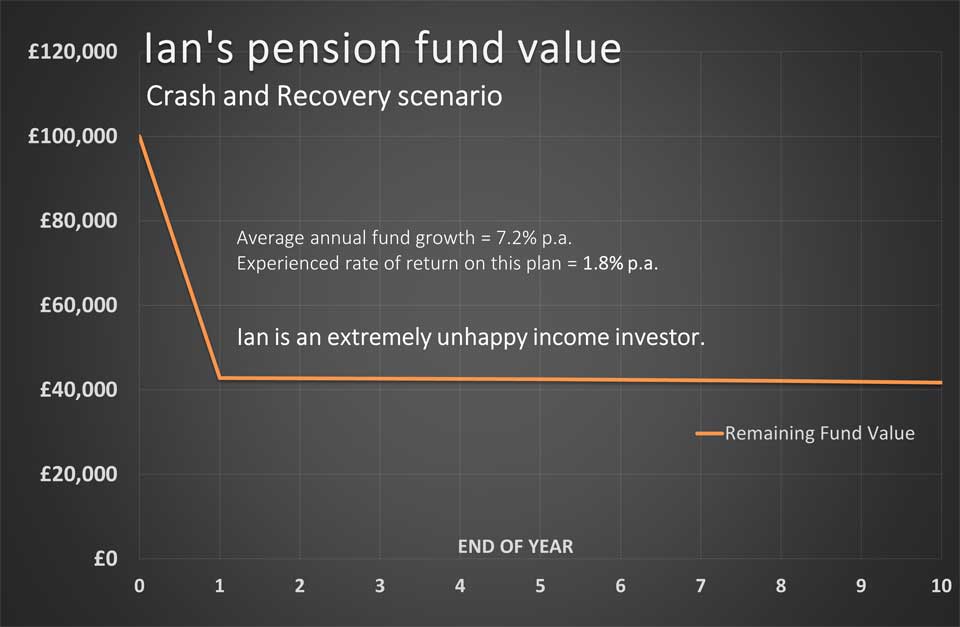

Sadly, Ian would have been very miserable throughout his investment journey in this ‘crash and recovery’ scenario.

Why?

As before, Ian might have expected to see his capital preserved (at £100,000) after ten years. (His fund price ‘averaged’ a return of 7.2% p.a., and he withdrew the same percentage of his initial investment each year.)

But, as you now know, that’s not how this works, and unlike the first magical early-boom example, this second (early crash) scenario is horrible news for Ian.

After taking his fixed income for ten years, he’d be left with just £41,700 in his pension pot.

That’s less than half of what he started with. Here’s how his fund value would look over time.

When we factor in Ian’s income withdrawals, his experienced rate of return would have been just 1.8% p.a.

(that’s more than 5% a year, less than the average return on his investment!)

So, in this scenario, Ian might view his income withdrawal pension investment as a disaster.

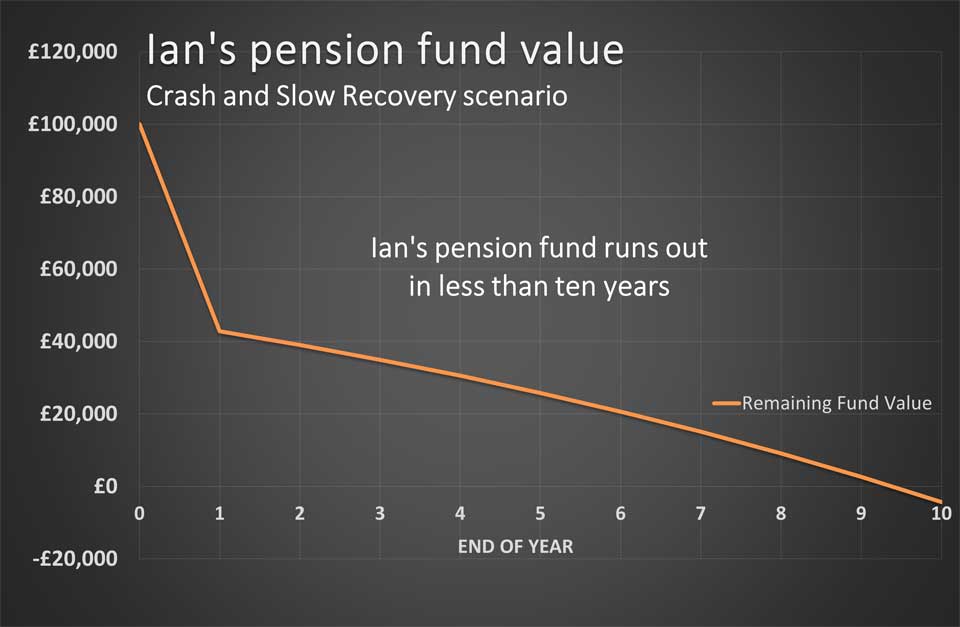

That said, his experience could have been even worse.

Let’s assume that the fund price recovery had been weaker and only recovered to its original £1 price by year 10. In this case, Ian’s pension pot would be exhausted (yes, all gone) before year 10 – as shown here.

Shall we re-cap the key points?

We’ve covered a lot of ground in this ‘About Money’ article – so here are the key learning points:

- Your personally experienced rate of return on an investment plan can vary (a lot) from the average annual return on your investment funds over time when you are:

• Contributing regularly to an investment plan.

• Taking withdrawals from an invested sum. - Only when investing a lump sum for growth should you expect your experienced rate of return to be the same as the average annual return on your fund – after charges.

- As you approach an investment goal (like retirement), you may have two of these investor situations running at the same time. You’ll have a substantial lump sum of pension funds invested while you continue making regular investments.

• In this case, if you don’t have much flexibility (on the amount or timing of your investment goal), you could consider taking a different investment approach to protect your existing fund holdings while still taking advantage of higher growth funds on your regular investments.

• Most investment and pension product providers allow this, but please seek competent advice for your unique situation. - Investment funds with the potential for high returns may occasionally fall heavily in price, and big price fluctuations can seriously affect your experienced investment returns.

- If an investment fund price rises quickly before levelling out:

• An income-seeking investor may enjoy a magical return.

• But a regular investor’s returns may be lower than the average return on the fund. - If an investment fund price crashes early on and later recovers:

• An income-seeking investor who needs to withdraw money from that fund might seriously deplete their funds.

• This problem is known as ‘sequence risk’ – because the order in which the fund price rises or falls is what really matters.

• And if the fund price recovery is slow, there’s a risk of fund exhaustion if the income withdrawals continue.

Bottom lines and next steps

Carefully consider all your income-generating options if you need (or will soon need) to draw income from your money.

Pension annuities should be considered in that assessment because those products guarantee an income stream for life.

And take good advice on fund selection for remaining invested monies.

Please be aware that generating a sustainable income from invested funds is not simple. So, it makes sense to take advice in this area. The challenge when discussing the price of investment funds (or homes!) is that young and old often hope for different outcomes. And we sometimes forget that asset prices don’t only go up.

So, be wary of investment advice from anyone without relevant qualifications or who relies heavily on their experience (or recent past performance) of investing or home-owning.

Your investment returns could be very different to theirs and will depend, as we’ve seen, on the price path of your investments over time.

For help in making better money decisions, please get in touch and see how Create Wealth Management can provide you with advice tailored to your unique financial goals and circumstances.