A 10 to 20-minute read – depending on your speed. This is the first of four ‘About Money’ articles on how to choose the right boxes for your money.

In this series, we’ll equip you with an eight-point checklist for assessing any financial product (or strategy) that anyone could ever put to you.

And this checklist will help you make sound money decisions – whatever your age, income, wealth and investing experience.

Could this checklist save your financial life?

Yes, absolutely. It’s possible that this checklist could save your financial life or that of friends and family members you share it with – in two ways:

First, following this checklist will help you avoid those hideous investment scams which wipe out the savings of thousands of people every year.

Second, this checklist will help you find suitable and efficient boxes for your money, which means you could either:

- Achieve more of your financial life goals – the goals that cost money.

- Reduce the amount you must save or invest for those goals.

- Achieve your life goals sooner.

Universal and Evergreen

The checklist we’ll outline in this series is also ‘Universal’ and ‘Evergreen’, which means it’ll help you make sound decisions regardless of:

- Your age, income, wealth and investing experience.

- What’s happening in the world – to the economy, stock markets, interest rates or taxes?

- Where you live in the world*

So, the checklist will help you assess any financial product or strategy that anyone could ever offer you.

- Please note: The examples of financial products and taxes we use to illustrate this checklist only apply to UK nationals who are UK residents. So, while the checklist will help you wherever (and whoever) you are, you must apply these checks to the products and tax reliefs available in your part of the world.

Do you currently have a financial adviser?

If you don’t yet work with a good financial adviser or coach, we’d encourage you to consider doing so.

And our ‘About Money’ article, ‘Should you pay for advice – and at what price?’ will help you to think through that question.

All our ‘About Money’ articles are designed to complement and reinforce any good advice you receive. So, we won’t cut across any professional adviser relationship you have.

Indeed, this checklist will help you understand the thinking that goes into sound financial advice. And equip you to ask the right questions if you’re unsure of any product-related features.

Learning this checklist will help you engage more confidently in money conversations—with professionals, family, and friends.

It might even make those (sometimes dull?) chats about financial matters more interesting!

What’s coming up in these four ‘About Money’ articles?

In the next ‘About Money’ article, we’ll outline our checklist and explain how and when you could use it to make sound financial decisions.

Then in ‘About Money’ articles three and four, we’ll dig deeper into each of those checks with examples of how they could help you to choose the right boxes (or strategies) for your money.

First, in this ‘About Money’ article, we’ll explore why you need to use a good checklist and where this ‘money box selection’ task fits in the broader financial planning process.

Very few people are aware of what good financial planning looks like, and most are surprised to learn that ‘money box selection’ is the wrong place to start designing your financial life plan.

So, let’s deal with that question now.

Are you starting in the right place?

Have you heard the joke about the tourist in Dublin who asks ‘Patrick’ for directions to the train station?

‘Ahh, the train station, you say?’ says Patrick, ‘Well, if I were you, I’d not start from here!’

Patrick’s answer is funny because it’s absurd – yet it perfectly describes the most common mistake people make when planning their money.

Too often, we start from the wrong place.

So, let’s be clear: your financial planning journey does not start by choosing financial products.

Any good adviser will tell you this:

Financial products are the last thing you need, to design your financial life plan.

Yes, you might need some financial products as a result of the planning process.

You might also need to change some of the products you already own—if they’re poor value for money or lack the features you need, for example.

However, the question of which money boxes to use is not the first thing to consider.

As Stephen Covey said in The Seven Habits of Highly Effective People, “we must start with the end in mind”.

And the end game of a sound financial life plan is to put the right money in the right hands at the right time.

Of course, in many cases, those hands will be yours in the future – like when you save or invest to build a fund to escape (temporarily or permanently) from work.

However, in more difficult situations (like suffering a severe illness or accident or dying unexpectedly), your financial plan must put enough money into other people’s hands.

So, they can cover their living costs (and/or look after you) if you’re no longer around or cannot earn an income.

Either way, a good plan ensures that you (or your loved ones) will have enough money to have, do, or become what you (or they) want – in the future.

If you can remember that when designing or reviewing your financial life plan, you won’t go far wrong. And, if you’ve not recently updated (or ever thought about) your longer-term life goals, try thinking about (and listing) those right now.

You could bookmark this page and come back later to learn about our checklist for choosing the right boxes for your money.

The key point for now is this:

Choosing your money boxes is important, but it’s only part of the financial planning process.

To design a financial life plan (or review one you made some time ago), you must start with your ideas about what matters to you. It’s your personal financial goals which will determine the money boxes you need.

It’s best to accept that managing your money can be complicated

Despite what you’ll hear from some #finfluencers and others on Social Media, managing and planning your money is not simple common sense.

Academic studies and books on financial literacy clearly describe the challenges we face in managing our money.

Most of us face often conflicting demands to:

- Keep our income levels above our expenditure.

- Juggle mortgage repayments with those to pay down other (higher-interest-charging) debts. And that gets very hard when interest rates rise unexpectedly.

- Build funds in accessible savings accounts to cover emergencies.

- Save and invest for our medium and longer-term life goals.

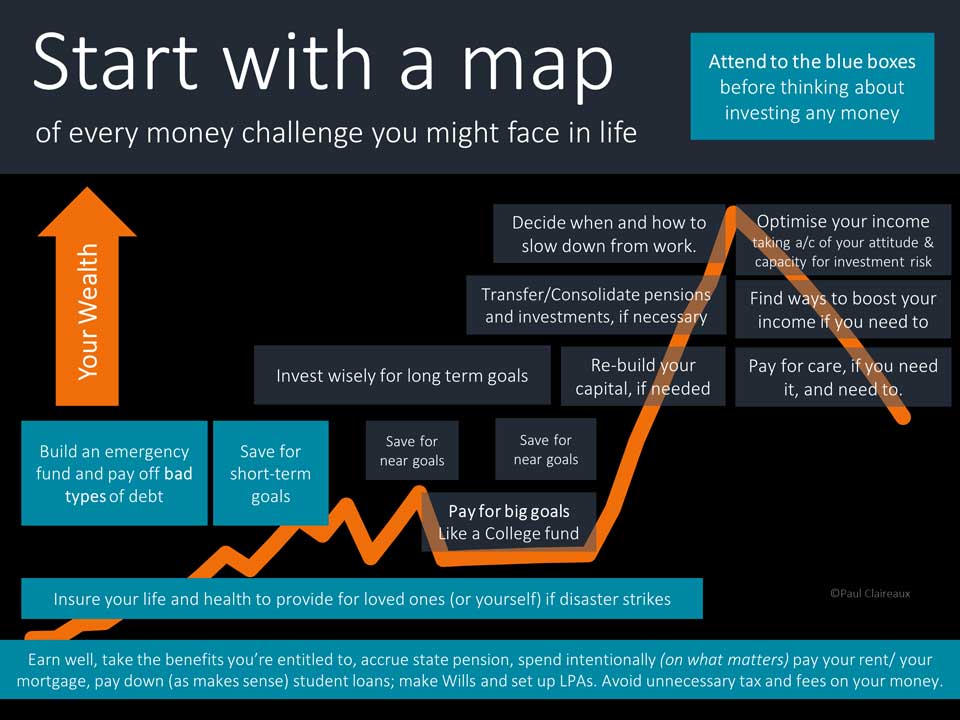

Look carefully at this map – which shows the money challenges most of us might face throughout our lives.

Thankfully, we don’t have to tackle all those challenges at once!

But let’s not pretend that dealing with them is simple at any stage of life.

Most people find financial planning concepts difficult because they learned nothing about them at school. And, incredibly, these concepts are not even taught in Business or Economics degree courses!

We know; we’ve checked!

So, yes, there’s plenty to learn, but Rome wasn’t built in a day.

The key is to know what to learn about planning your money. And we’d urge you to start with these kinds of questions:

- How could you plan your money so it’s connected to what matters in your life? (We covered that here)

- How could you choose the right boxes for your money? (that’s what we’ll cover in this series)

- How could you choose the right level of risk for your investments in those money boxes? (We covered that here)

- Should you pay for advice, and if so, what’s a fair price? (Covered here)

- How do we mislead ourselves about money? (This is the behavioural science around money, and we’ll cover these challenges in future ‘About Money’ articles also.)

For now, be aware that our biggest behavioural challenges arise from confused and conflicting ideas about financial planning and product selection.

So, learning basic processes for these tasks can save you from financial anxiety and some big money mistakes.

We all need to know (in broad terms) how to plan our money, choose the right boxes for it, decide on the right level of investment risk, and find a competent adviser if we need one.

And we’re committed to helping you learn how to do all of that.

Let’s plan to overcome the overwhelm

More specifically, whether you work with a financial adviser or plan your money on your own – you need to know how to:

- Choose between different bank savings accounts, pension plans, investment accounts, insurance bonds and other money boxes.

- Consider the pros and cons of investing directly in other assets (like property, commodities, antiques, fine art, etc.) that are not normally held in a money box.

Most people make mistakes with their money during their lifetime, and we could describe dozens of behavioural errors that cause this.

For now, let’s say that these errors arise because we all possess an energy-saving device called a brain!

So, our brains tend to avoid hard work if they think they can get away with it, which means we grab quick answers where we think they’re available.

Yes, we can tell ourselves (til we’re blue in the face!) that ‘financial products are the last thing we need’ – and that we should focus on our planning. However, we will still be tempted by (what we think are) quick product answers to our complex financial challenges.

For example, here’s a question we’re often asked by people in their 20s and 30s.

“I know I need a pension. Can’t you just tell me the best pension to buy?”

How would you answer that question?

Our answer goes something like this:

Yes, you might need a pension, but not everyone does in their early working years.

For example, if you’re young and self-employed, renting your home and have a limited scope to save, a Lifetime ISA might be a better money box for you – for now.

Financial planning is a ‘Catch-22’ problem.

Hopefully, you can now see that you can’t decide what money boxes you need till you decide what you need those boxes to do for you. And you can’t decide between your money box options until you know how to assess them!

The sad thing is that this hurried (‘just tell me the product to buy’) approach to planning is why so many people get stuck and give up.

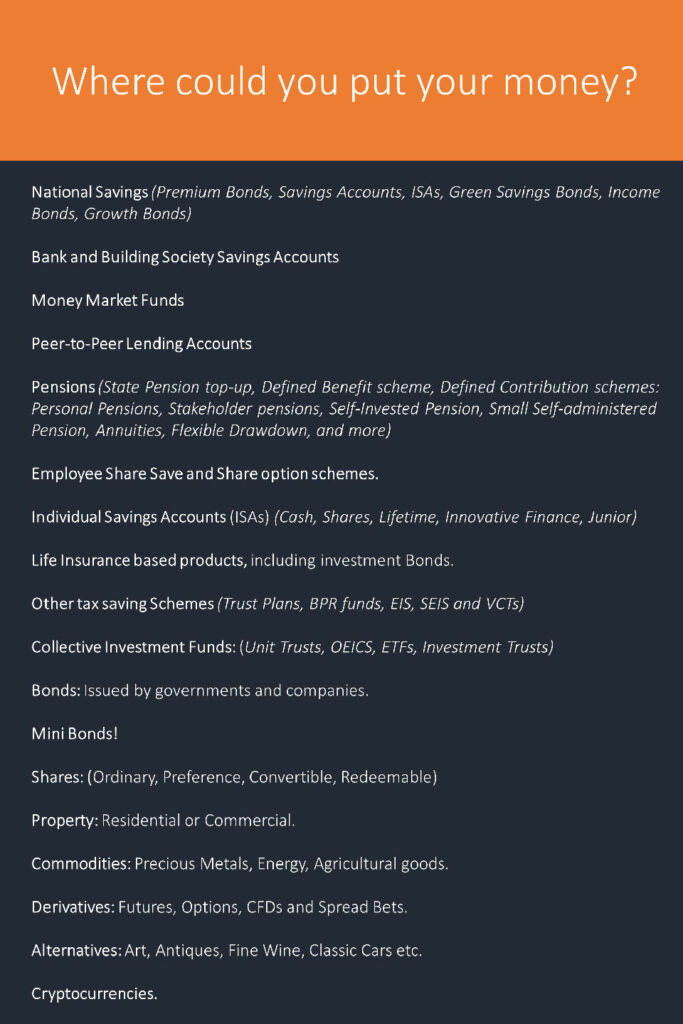

Here’s the money box choice challenge you face!

Here’s a high-level list of places where you could choose to put your money!

Note: We’ve left out the option of investing in your own business, which does have tax advantages and significant potential upside if your business is a great success but carries a high risk to your income and capital otherwise.

How many people can honestly say they’re familiar with all the money boxes and investment options listed above?

Not many unless they regularly advise in all those areas and stay abreast of the features, risks and benefits of all those choices.

Of course, that’s just a generic list of product types. So, even if you knew which money boxes were best for you, you’d still want to compare similar product types from different providers.

And while it’s relatively simple to compare savings accounts, it’s extremely difficult to compare investments and pensions from the many providers who offer those products.

So, you need a sound checklist to assess your money box choices – and sound financial advice in this area is extremely valuable, too.

Learn enough to scare off the scammers – before they get you!

It’s bad enough to discover you’ve put some money into a slightly unsuitable financial product. But, if there are no enormous (tax or product) penalties for withdrawing your money from an unsuitable product, you should be able to correct your mistake.

On the other hand, it would be a disaster if you invested a large slice of your wealth into a hideously expensive financial product – or something worse like Bernie Madoff’s Ponzi scheme. So, you need to avoid personal financial disasters like that if you can.

Madoff’s scam was of such epic proportions that various films have been made about it – including this documentary and this story of the man and his family. Sadly, thousands of institutions and wealthy individuals lost billions in Madoff’s scam – including these famous people:

- Steven Spielberg: The Academy Award-winning director.

- Jeffrey Katzenberg: Co-founder of DreamWorks Pictures with Spielberg.

- Eric Roth: American screenwriter for “Forrest Gump” and “A Star Is Born”.

- Larry King: Emmy-winning American television and radio host.

- Kevin Bacon and Kyra Sedgwick: Golden Globe-winning actors.

- Zsa Zsa Gabor: Former Miss Hungary (1936) who starred in Moulin Rouge (1952).

- John Malkovich: American actor, director, and producer.

That information is all in the public domain.

The financial institutions which invested with Madoff were clearly foolish because the warning signs were there for those who knew the basics about risk and reward in investments.

However, we’d not suggest that these famous, non-expert individuals were fools to fall for Madoff’s Ponzi scheme. They were more susceptible to behavioural biases and prone to taking shortcuts in their thinking. And, in this instance, their mistake was based purely on trusting the man.

We must assume these people were not equipped with a sound ‘moneybox’ checklist or process for considering Madoff’s offer, and that error cost them fortunes. And we want to prevent anyone (regardless of their wealth) from falling for these scams (or others) in the future.

It could save you from putting your money into the wrong financial products. And it might just save your financial life.

Are scams still common today?

Sadly yes.

Bernie Madoff was arrested in 2008 and died in prison, aged 82, in 2021, but Scams and Investment Fraud remain very common today, and during the Pandemic, the numbers surged.

In the UK alone, more than 400,000 frauds were reported to Action Fraud, and more than £500 million was lost to investment fraud. You need to stay alert to these frauds, and a checklist is a great way to protect yourself.

As soon as you tell a scammer that you’re going to take your time and analyse their offer – they will run for the hills.

They know they won’t fool you. So, they move on to find a more susceptible punter!

Could your financial planning be more professional?

Our personal finances are… well, ‘personal’.

So, we tend to deal with them as we might various tasks in our home life – where we might not always adopt a business-like or professional approach!

And let’s be honest: Most people find checklists (like budgets, perhaps) on personal money matters to be incredibly boring!

It just happens that checklists are essential in this area. Failing to make basic checks on where you put your money exposes you to risks of losing thousands (or tens of thousands) of pounds in the future.

If you’re not convinced about the value of checklists, read the book, ‘Checklist Manifesto’ by Atul Gawande (a surgeon and public health expert) who says, “Under conditions of complexity, checklists are not just helpful; they’re required for success.”

Various professionals use checklists, especially where human lives (or health) are at risk.

Aircraft pilots use checklists to ensure all the plane’s systems are working before they line up on the runway to take us on holiday. They also make regular checks on their systems and the external environment (weather and other traffic!) on the journey. And thank goodness for us that they do.

Pilots are continually running through their checklists – and they divert around violent storms.

Likewise, Surgeons use checklists to ensure they complete every step in their complex procedures.

Of course, you might argue that aviation and surgical theatres are complex and high-risk environments. You might say that no lives are at risk when we sit down to make a plan for our money.

And that’s true, but our financial lives (and those of our loved ones) are most certainly at risk if we leave gaps in our financial plans.

So, you need to identify and close any big gaps in your plan as soon as possible.

Coming next

In the next ‘About Money’ article, we’ll outline our FILTRATE checklist for choosing the right boxes for your money.

And we’ll offer you guidance on how and when you could use our checklist to make sound financial decisions.

See you there when you’re ready for that.

Thanks for dropping in.