A 10 to 20-minute read, depending on your speed.

The shocking thing is that almost no one knows how to design a financial life plan.

Yet, there’s a widely agreed-upon (and life-changing) approach to this challenge that can help you regardless of where you live, your age, or your level of wealth.

So, in this final of three insights in this series, we’ll reveal this (secret) approach to planning your money for the long term—in seven awesome steps.

You’ll also lay out your ideas for your future life – in pictures – on one sheet of paper!

If you’re up for this, read on.

What we’ve covered, and what’s coming up?

In the first Insight, we learned why financial planning is a secret – and explored the personal financial crises that can arise when we fail to plan.

So, be sure to start this series there.

In the second Insight, we looked at the broad benefits of financial planning and explained why a sound approach to this work is essential.

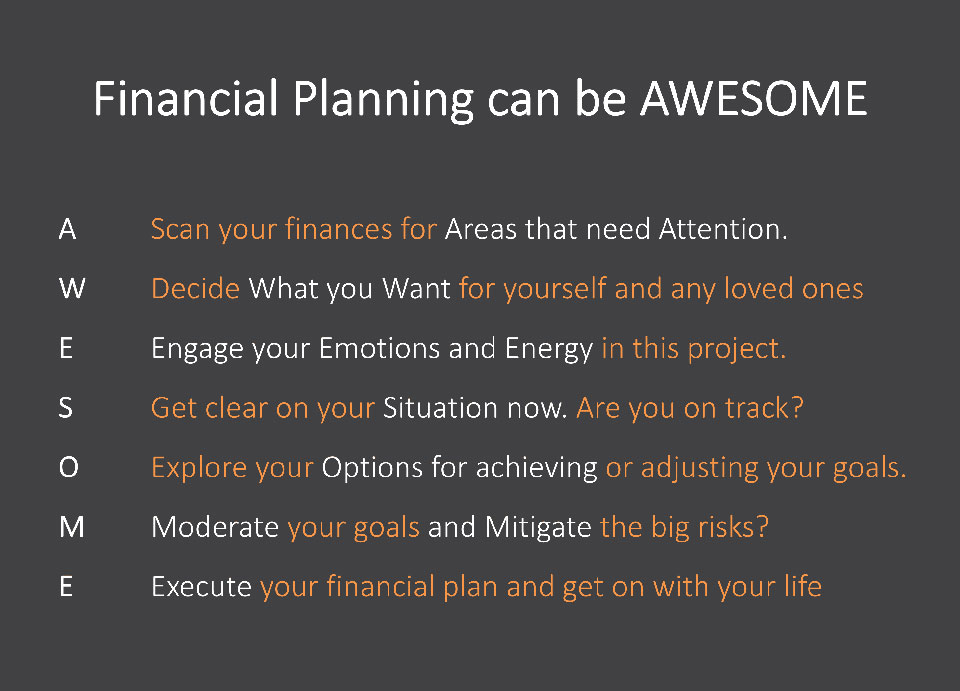

We also explored the first of the seven (A.W.E.S.O.M.E.) steps in this planning process.

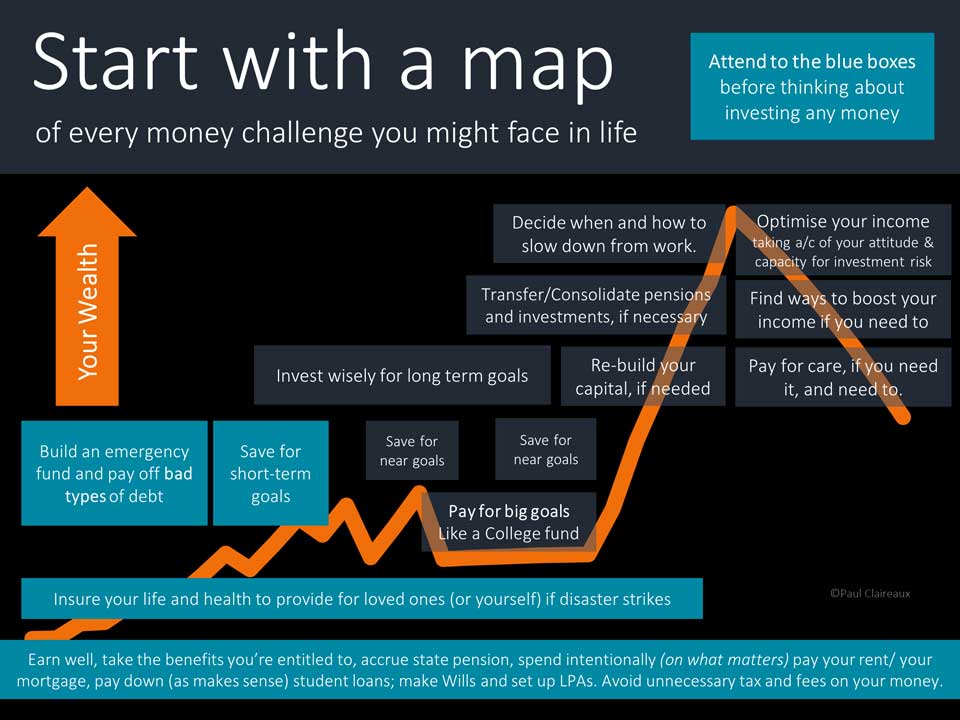

The letter ‘A’ reminds us to ‘Attend to the right Areas’ of our finances in the correct order.

You can find a reminder of those areas for attention linked here

The priority tasks, among all the money challenges we might face, are shown in the blue boxes below.

In this third Insight, we’ll explore the other six steps for designing your AWESOME financial plan.

So, let’s crack on with this now.

‘W’ is for ‘What you Want’ – and what you need.

Once you’ve decided (and agreed with your adviser if you have one) on the areas of your finances that may need attention, the next step is simple and comes in two parts.

First, decide roughly how much money you want to have (or provide) for your goals.

And, to keep things simple, estimate the cost of your goals in today’s money terms.

Don’t worry about inflation at this stage – you can deal with that later – with professional help if needed.

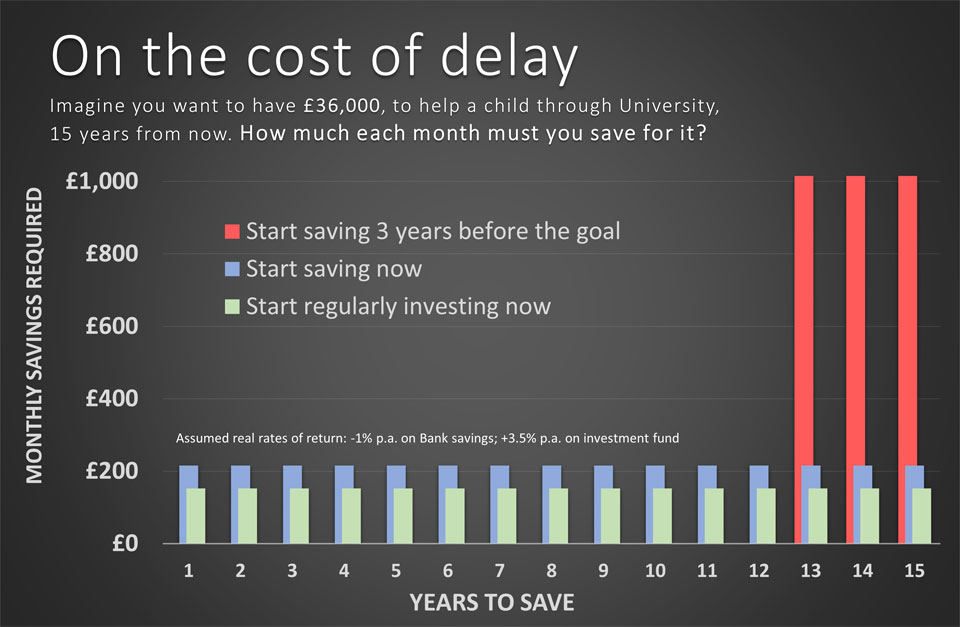

For example, let’s say you want to help your 3-year-old child (or grandchild) with their college or university living costs – 15 years from now.

Just estimate what money you want to provide – to help with accommodation costs – for example.

Perhaps the number is £2,000 yearly for three to five years – depending on the course.

Or, if you’re wealthier, perhaps you’ll provide £6,000 a year to cover more of the student’s expenses over that period.

There are no right or wrong answers.

You’re simply listing financial goals that are important to you.

As you develop your plan, you’ll see how much money you need to save (or invest) to achieve all your financial goals.

You’ll also see that starting regular savings (or investments) early can substantially reduce the amount you need to set aside to achieve your long-term goals.

Everyone is limited to what they can afford to save or invest for the future – and to pay for any vital insurance policies now.

So, depending on what you can afford, you can change the size of the funds you target for your goals.

And it makes sense to consider your future needs – and the needs of your financial dependents.

So, jot down the minimum amounts you (or your loved ones) will need for your financial goals, alongside the ‘ideal’ amounts you want to provide.

And think hard about the levels of life assurance and long-term sickness (Income Protection) insurance you need.

You’ll want to know your loved ones will have enough money to:

1. Look after you and provide for themselves if you are ill for an extended time.

2. Have the lifestyle you want for them if you were to die at a time when they depend on you – either for income or to care for your children, for example.

The second question relates to when you’d want these goal funds available.

Personal life insurance policies should ideally pay out almost immediately after the insurer is notified of the insured person’s death.

However, such quick payments are typically only possible if the policy has been written into a suitable trust.

Without a trust, there can be significant delays while the estate administrators obtain permission to pass money from the deceased’s estate to beneficiaries.

It’s certainly worth seeking professional advice about personal insurance plans. Indeed, you might save money by taking advice – compared to going directly to insurers.

Of course, you’ll also need to decide (roughly) when you want other long-term investments and your pension to become available.

Precise amounts and dates are unnecessary at this stage – because you can refine your plan later.

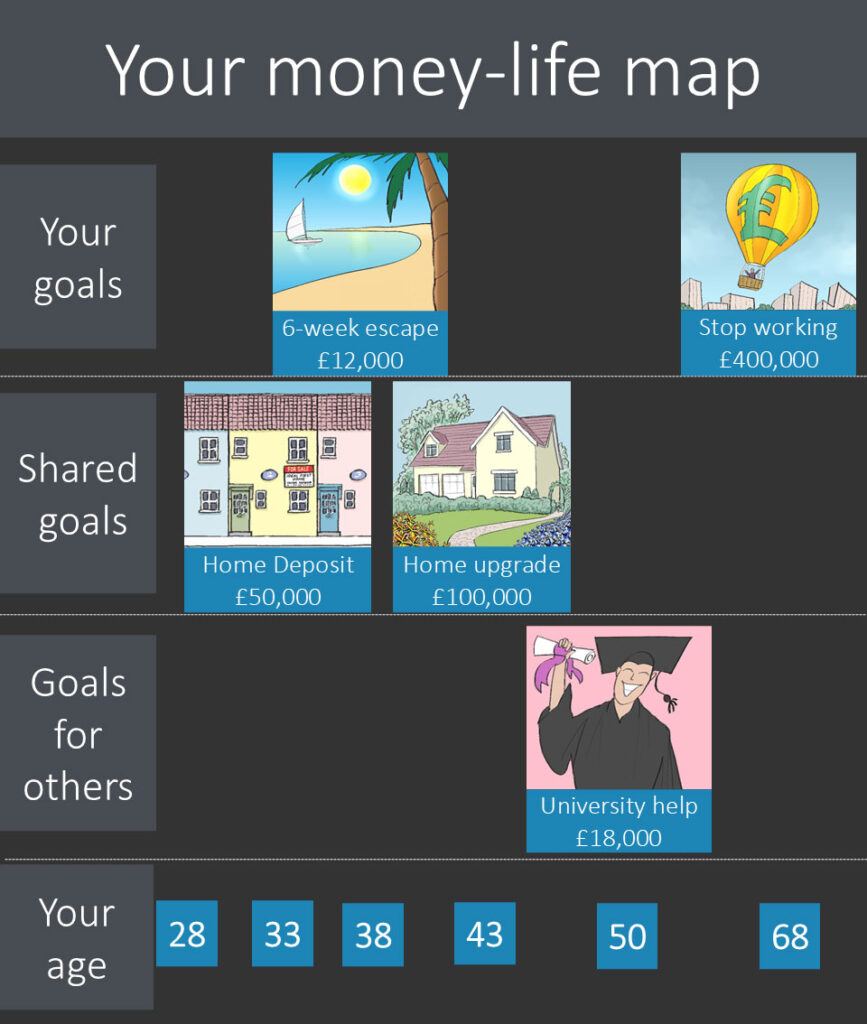

For now, you only need a rough picture of your financial life goals.

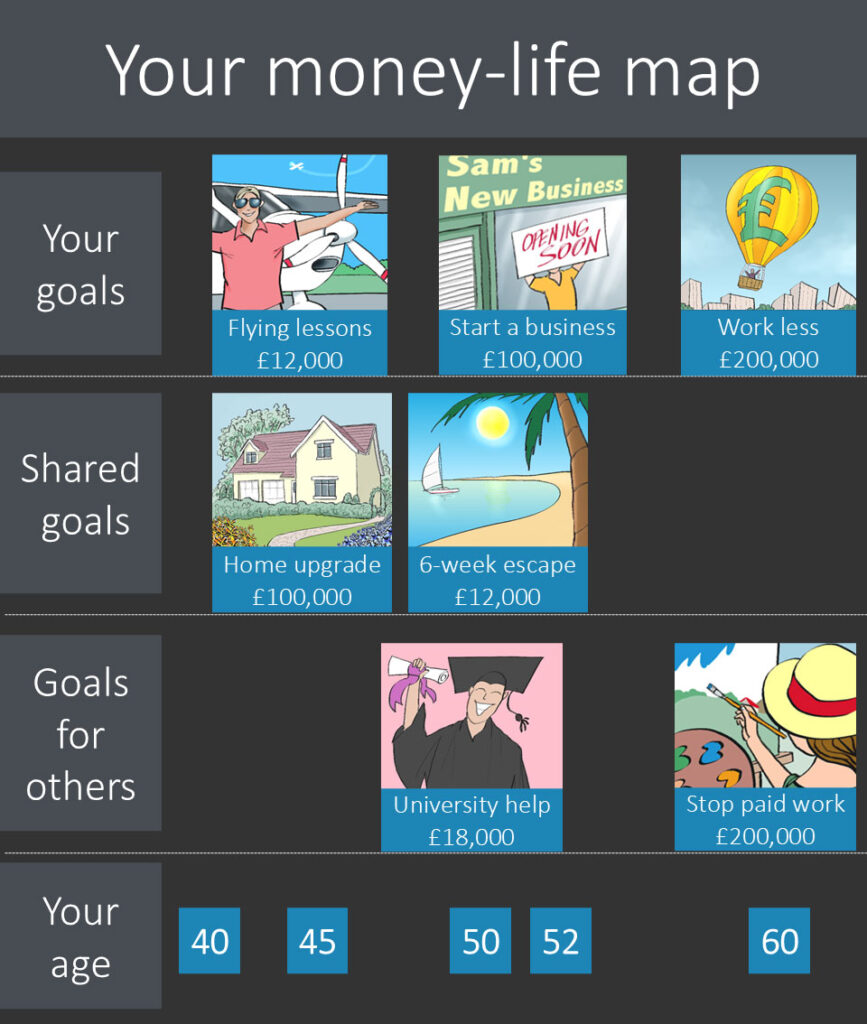

And it can help enormously to lay out your goals – on a big sheet of paper, with images like this.

Each person’s picture is unique, so, here’s another example.

And, of course, your money-life map will be unique to what YOU want – for yourself and any loved ones who depend on you.

So, take some time to map out your unique set of financial life goals, and consider sharing this with your life partner if you have one.

As an aside – it’s also worth noting any flexibility you have – on the amounts and timings of each goal – because this can affect whether and how it makes sense to invest for them.

And if you’re unsure how to estimate the costs of your goals, get help from a professional.

For example, a good financial planner can help you calculate the size of pension (or other) funds you’ll need to escape or slow down from work.

You could be miles out on your estimate of the retirement fund you’ll need – unless you make sensible assumptions about:

1. The income yield you can reasonably expect from your pension and other investments.

2. Your state pension income.

3. The income you’ll need for the standard of living you want in retirement.

In a future Insight, we’ll outline another ‘one sheet of paper’ exercise to help you estimate the funds you’ll need for retirement – where that’s many years away.

However, if you’re within a few years of stopping or slowing down from work, it could pay to seek advice – to develop a detailed plan.

‘E’ is for: Engage your emotions – and energy!

Now, once you’ve decided (broadly) what pots of money you want (for yourself and others) in the future, it’s time to pause and reflect.

We suggest you sit back and consider WHY you want to:

1. Build those funds for the long-term future.

2. Insure your life (and health) to provide others with funds in the near term – in the event of a personal disaster.

So, take your time and look at the picture of your goals (including any vital insurance) and ask yourself these questions.

How might you feel knowing the money you want to be available will be there when it’s needed?

And, if you’re providing for loved ones, how do you think they will feel about this plan?

The chances are you’ll anticipate feelings of confidence, calm and control.

These positive emotions (about the expected freedom to do more of what matters to you) will help you achieve your financial goals.

And perhaps those feelings will be enough to engage you in this planning process.

That said, it can also help to consider how you might feel if those monies were NOT available when needed.

How would you expect to feel in that situation?

And how might your loved ones feel if they didn’t have enough money to cope – if you suffered from a severe and long-term illness or you died in an accident?

We’re sorry to prompt these uncomfortable feelings and suggest you don’t dwell on them for long.

Instead, re-focus on the more positive feelings of having (and acting on) a sound financial plan.

Financial planning is the most valuable of all financial services, but a plan has no value unless it is actioned – and engaging your emotions will help you do that.

Finding the motivation and energy for your goals

You might not think looking for the obstacles to achieving your goals is a smart way to get great results.

However, the evidence is that this approach can help us to achieve our most significant life goals, such as passing an exam, building good exercise habits, quitting smoking, and more.

We also know it doesn’t help to spend lots of time dreaming about what we want – while deliberately denying or ignoring the obstacles.

So, you might wonder why so many ‘self-help’ gurus suggest we do that, especially when their ‘manifesting’ suggestions are proven to undermine the efforts of vulnerable people who need real help to achieve more in life.

Hard work and problem-solving matters. Who’d have guessed it?

So, we urge you to follow the science to gain more control of your money, your health, or anything else that matters to you.

Read ‘Rethinking Positive Thinking’ by Psychologist Gabrielle Oettingen for more on this proven approach to achieving more.

Yes, Oettingen’s ‘WOOP’ process starts with listing your ‘Wishes’ – about what you want to change, what good ‘Outcomes’ might look like – and how you might feel when you achieve those goals.

However, the key to this process is mental contrasting – where you focus on the Obstacles that could stop you from doing what’s necessary – and develop Plans for responding when those obstacles appear.

So, keep the ‘WOOP’ process in mind as we explore this AWESOME financial planning process.

And, in case you’ve lost track, we’re now at the letter ‘S’ 😉

‘S’ is about your Situation report.

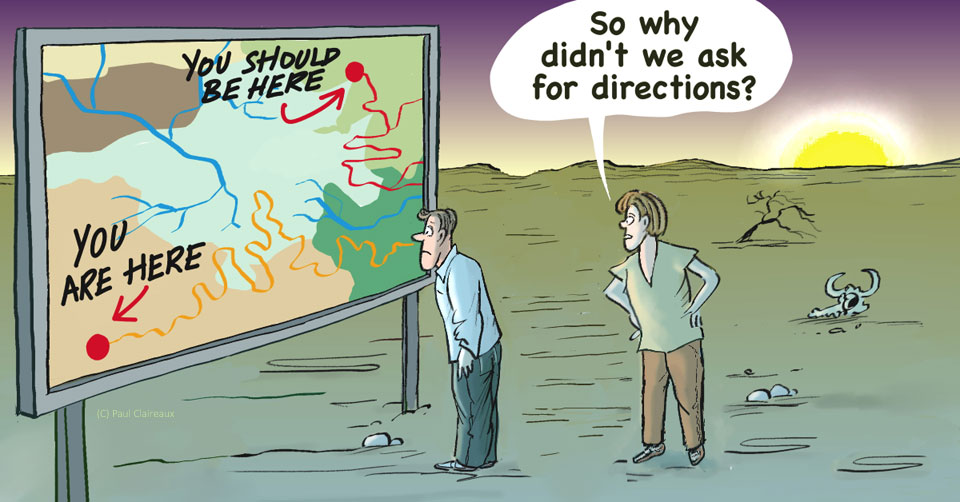

You can’t plan a route to a goal unless you’re sure where you are now!

So, you (and your adviser, if you have one) need a clear picture of your current financial situation.

This means knowing:

- The regular income you have coming into your bank account

- Your regular outgoings – on essential living costs and discretionary items, like holidays and days out

- Any amounts you owe – on a mortgage and any loans – and the payments you make

- The current value of all your assets (your home, any other properties and valuables, your pension funds, investments, insurance plans, national savings and cash at the bank)

- The product and fund details of those financial products

- Your attitude to investment risk

- The regular amounts you’re paying into any insurance, investment and pension plans

- Whether you’ve written a Will and set up Lasting Powers of Attorney

- Any beneficial interests you have in Trusts

- Any gifts of value you’ve made in recent years

And there are more questions to consider if you run your own business.

You (or anyone advising you) must have all of this information to develop a sensible plan that puts (or keeps) your financial goals on track.

That is why you will never find a financial plan tailored to you in a book, blog, or video.

Regardless of how clever or famous the #finfluencer is, they cannot advise you on your financial life plan and investing – unless:

1. They are qualified and regulated to do so.

2. They know all your financial details – and fully understand your life goals.

‘O’ is for: Options for achieving or adjusting your goals

Hopefully, you can now see that a suitable set of financial solutions (to get your goals on track) must be unique to you.

So, we can’t suggest specific solutions here.

However, we can outline the four vital areas that you must (or your adviser will) consider for building an efficient financial plan – or refining the one you have.

And by efficient – we mean a plan that helps you achieve your financial goals without wasting your money on unnecessary taxes, excessive product or advice charges or poor investment returns.

1) What money boxes could you use to hold your money?

There’s a lot to think about under this heading, so we covered this question in detail in another four-part series of Insights.

For now, be aware it’s vital to make the right money-box choices – or you could:

• Lose out on valuable tax reliefs and other ‘free’ money benefits that could seriously boost your funds – and reduce the cost of achieving your goals.

• Fail to have access to your money when you want it.

• Pay excessive charges that eat up a large part of your investment returns.

2) What level of investment risk would suit you – on each of your life goals?

Again, this question is too big to answer within this Insight – but we’ve covered it in detail in this three-part series.

In short, a suitable investment portfolio should take account of:

• Your need to take investment risk.

• Your attitude to investment risk.

• Your capacity to take investment risks – on each of your life goals.

• Your knowledge, experience, and calmness about investment risk.

So, as with the money boxes question, good investment fund choices are vital.

And, unless you’re highly competent in this area (and able to control your emotional impulses when stock markets get shaky), it’s worth seeking advice from a professional adviser.

3) Putting more money towards your future life goals?

If you’re not wasting money (with the wrong money boxes or investment funds) but are not yet on track to achieve your financial goals, could you put more money towards them?

To answer this question, you’ll need a reasonable estimate of how much to save or invest for each goal.

And you might be able to find those numbers for yourself – if you can find (and drive) a good calculation tool – that has sensible assumptions plugged in.

The problem is – that not all financial calculators are easy to drive, and not all are set up with sensible assumptions.

So, taking advice helps.

One thing you can do, however, is make an intentional spending plan.

This is more interesting than a budget and gets you focused on spending less money now (on things you don’t need) to have more money for what matters to you (and your loved ones) now and in the future.

4) Adjusting your goals if you need to

Once you’ve dealt with the three steps above – you may discover you can afford to fund your financial life goals.

Better still, you may find you could reach a financial goal much earlier than you thought. And this is not an uncommon discovery for those in their 50s – exploring when to stop or slow down from work.

It’s also common, but wrong, to assume that everyone must wait until the state pension age – or their employer’s traditional pension age before slowing down from work.

That’s a completely outdated idea.

Some may need to wait until one of those dates – but not everyone. So, start doing these sums.

Of course, your planning may reveal that you cannot afford to achieve all your life goals in the timeframes you’ve set.

That’s perfectly normal, too, and in this case, you’ll need to explore whether to:

- Scale back on the size of one or more of your goals

- For example, £20,000 would undoubtedly buy a holiday of a lifetime for a couple, but £10,000 could pay for an excellent break too

- Delay one or more of your goals until you have the money you need

- Remove a ‘nice to have’ goal from your list – to improve your chances of achieving your ‘must-have’ goals

Making these choices can be challenging.

However, if you engage in the process, you remain in control of any changes to your plan.

And all good financial planners will invite you to do that.

OK, so far?

Well, here’s the good news.

You now have a great picture of your financial life goals – and how you’ll achieve them.

So, this is significant progress, and you have just two steps to go.

M: Moderate your goals and mitigate significant risks

You now know that financial planning is an iterative or circular process.

Once you know which areas of your finances need attention, you consider what you want (for yourself and loved ones in the future), then enhance (or tone down) your ambitions once you know what’s achievable – without breaking the bank or taking crazy investment risks.

Financial planning done well is engaging and empowering – because it’s about designing your future life.

However, we still need to deal with two significant risks to your plan.

And this ‘M’ step covers those.

First, it’s easy to make overambitious plans in the excitement of the life planning process.

And we know this risk is real because research shows that nearly 90% of people report failing their New Year’s resolutions just two weeks into the new year!

Motivation and resilience are topics in their own right – which we may return to another time.

For now, let’s remember that Rome wasn’t built in a day – and our goals need to be SMART – which means they’re Specific, Measurable, Achievable, Relevant and Time Boxed.

We can all agree that a 90% failure rate is a disaster.

And we know you’d prefer a 90%+ chance of success!

Well, if you make a sound financial plan and review it regularly, that’s what you’ll have.

So, if you feel you might have got overexcited about future possibilities, consider moderating your goals to be more realistic.

There’s no point in planning to cut out every activity that gives you joy today – to build a bucket of money 30 years from now.

Your financial plan is not just about the future – or one BIG personal financial event.

Even retirement doesn’t work like that for many people today.

So, you need a sound plan that enables you to enjoy the journey towards your futures.

Mitigating big risks

The second set of risks to your plan’s success are extreme events outside your control.

So, you’ll want to stress-test your plan to ensure it won’t break if certain unexpected and unpleasant events occur.

By now, you’ll have planned to have enough life and health insurance (for yourself and your partner if you have one) so you don’t face a financial disaster if a health (or worse) disaster strikes.

However, you should also check how your income and wealth would be affected if there was:

- A significant fall in the prices of your invested assets – in property, the stock market or elsewhere

- A significant rise in interest rates

Again, a good financial adviser or planner will help you consider these scenarios – and offer suggestions to strengthen your plan if needed.

‘E’ is for: Execute your plan

Executing your plan is the seventh and final step in the AWESOME financial planning process.

The tasks here might include:

- Changing spending habits and paying off debts if you have them

- Arranging your financial affairs (including setting up wills and powers of attorney) to ensure your family can quickly deal with your assets if and when those times come

- Setting up regular payments to any investment and insurance plans you need

- Investing lump sums (or transferring existing investments) into more suitable products

A critical part of this step is selecting the right financial products from the vast number of providers on the market.

And this is another area where professional fees are worth paying.

Good advisers help you find suitable financial products at sensible prices.

The bottom lines – and next steps

So, there it is.

That’s financial planning in seven AWESOME steps – an acronym designed to be easy to remember.

And here’s a reminder of the steps we’ve covered.

Of course, you might forget the details behind those seven steps.

You might even forget some of the names for these steps.

However, if you remember that this is an AWESOME process – and that the first three letters spell ‘AWE’, you won’t go far wrong.

Awe is one of many sources of happiness – a topic we’ll return to soon.

So, we hope you’ll share this awesome process with your friends and family – and encourage them to explore financial planning, too.

The process can help everyone plan their money, regardless of age or where they live.

Just follow those seven steps to develop your first financial life plan.

And follow them again – to check your progress each year or when your situation or ambitions change.

OK – but isn’t this all just common sense?

Sadly not.

Despite what some people might tell you, managing and planning your money for the long term is not simple common sense.

Humans have not evolved to think about long-term financial planning.

Managing our money – with one eye on the future is challenging for everyone.

The cash flows are complicated.

We need to:

- Keep our income above our expenditure

- Build a fund of accessible money for emergencies

- Keep up with the repayments on any mortgage or other debts

- Choose suitable money boxes, strategies and insurance products for our money

- Choose suitable investment funds to hold in those money boxes – to secure long-term growth

- Choose other funds when we’re nearing retirement and need to draw income

- And so on – as outlined in that ‘Money Challenges Map above’

Financial planning can be hard to tackle alone, especially as your wealth grows and there are more moving parts to review.

So, consider the benefits of taking advice from someone with the expertise and experience to help you plan your money in a way that connects it to the life you want.

And if you’re wondering what type of advice you might need (and a fair price to pay), we’ve got you covered there, too. Get in touch to see what Create Wealth can do for you!

Thanks for dropping in