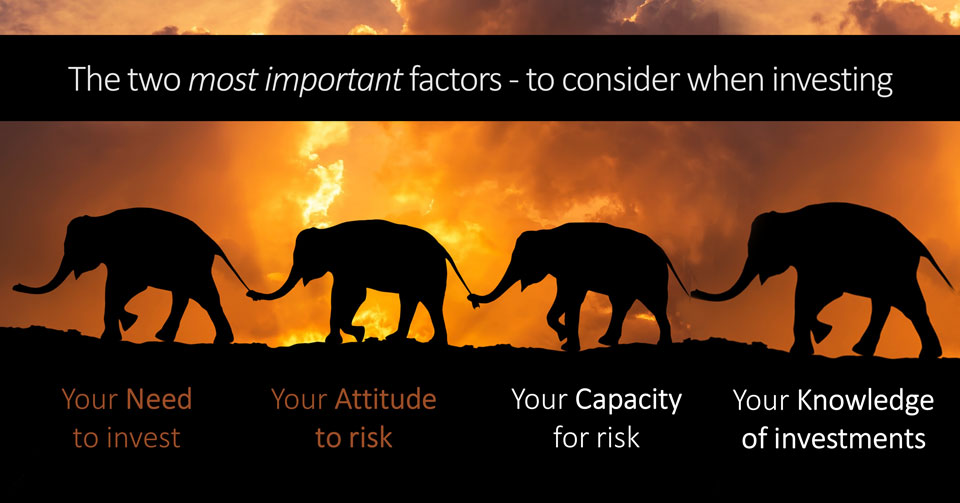

A 7 to 10-minute read, depending on your speed. In this final (of three) ‘About Money’ articles, you’ll learn the two most important factors to consider – when trying to decide what level of investment risk to take – on each of your financial life goals.

These ‘About Money’ articles are written to help all (new, recent and experienced) investors because we must all ensure that the risks we take on our investments are right for our personal situation.

Do you need to read the earlier ‘About Money’ articles?

Yes, absolutely, because in the first two ‘About Money’ articles, we:

- Showed why it’s impossible for anyone (however smart they claim to be) to advise you on investments from a blog, book or video! Your adviser needs to be qualified AND know all about your personal circumstances and ambitions.

- Outlined the ten foundations of personal finance to sort out – before you consider investing.

- Explained why investments tend to produce higher returns than cash savings – over the long term.

- Illustrated the effect of a small extra return – over the long term.

- Warned of the extreme risks of aiming for much higher returns than mainstream diversified funds can deliver.

- Pointed to the overwhelming choice of (140,000) investment funds and why analysing those is the wrong way to approach this.

- Provided you with a simple model to understand the risk and reward spectrum of investment funds.

- Explained the first two important factors to consider when investing – about your ‘Need’ to take risk and your ‘Attitude’ to it.

So, please start with the first ‘About Money’ article in this series – which covers the first six points above.

Now let’s complete our outline of the four (NACK) factors to consider when investing, starting with the vital question of your capacity for risk.

C is for Capacity for Investment Risk

Your capacity for risk is arguably the most important factor to consider when investing – for one simple reason.

At times, your capacity for risk may be very different to the risk level implied by your attitude to risk assessment.

Here are two examples to help you understand this:

Let’s assume that, like most people, your attitude to risk has been assessed as being ‘moderate’ or ‘balanced’ or level 5 on a scale of 10, or whatever number or word is used on the test you completed.

Remember, most people’s attitude to risk comes out at around that level.

Also, be aware that any attitude to risk scale is meaningless unless you have seen (and agreed to) a clear definition of the scale you’re told applies to you.

So, be sure you do that.

The critical point to note here is this:

If you only consider your (say, ‘balanced’) attitude to risk result, you might assume it’s sensible to invest a reasonably high proportion (70% to 80%) of your money for this goal into stock market-type funds.

The problem is, your assumption might be very wrong!

To understand why, let’s assume you have two main goals for your savings and investments.

Goal 1 – a short-term lump sum investment

Your first goal is to invest a (recently-inherited) lump sum of money – which you must have available (to help a child with their University living costs) starting in five years’ time.

Let’s also assume that you have no other funds to call upon if the value of this investment falls heavily at around the time it’s needed.

Clearly, you have a very limited capacity for investment risk for this goal. So, you’d be wise to invest this lump sum extremely cautiously to protect its value over time.

And, you might consider keeping a large portion of it safe in the bank.

Goal 2 – investing regularly for the long-term

Your second financial goal is to build a fund that will allow you to escape (or slow down from) work in 20 or 30 years. And you plan to fund this goal by making regular monthly investments throughout that period.

For this goal (assuming you won’t need to access those funds before your target date), you clearly have the capacity to take more investment risk and, hopefully, reap the benefits from much higher investment returns.

You might even view any near-term falls in the stock market as good news… because your future regular investments will then buy shares (or units) in your funds at lower prices.

This benefit, which may arise from long-term regular investing is known as pound (or dollar) cost-averaging – and we covered it in another ‘About Money’ article here.

Hopefully, you can now see that it’s absolutely critical to pay attention to your capacity for risk.

Doing so can improve your financial plan in two ways:

First, it helps you see where it might make sense to seek higher returns – for example, on longer-term and regular investments for growth.

Investing over the long term can boost the final value of your funds, which you could use in three ways:

- To achieve more of your financial life goals.

- To cut the cost of achieving your existing goals.

- To reduce the time it takes to achieve them.

Here are some situations where you might have more capacity for investment risk if your attitude to risk assessment suggests a cautious approach.

- You’re very flexible about the timing of a particular goal. (For example, if you’d be OK with a holiday of a lifetime (planned for ten years from now) being deferred for a year or two if your investments were significantly down at the 10-year point.

- You’re extremely flexible about the monetary amount you’ll have for this goal (e.g. you’d like to have £20,000 for that holiday, but £14,000 would be acceptable too),

- You’re regularly investing money over many years – so short-term bumps in the road won’t concern you and might even be to your advantage.

- You have many years (more than 10) before your financial goal (say retirement) arrives. So, that’s very different to a 5-year goal to help a child through University.

- You’re investing purely for growth, and you will not need income or access to your capital earlier than you say in your plan.

- You’re only exposing a small proportion of your overall wealth to risky assets. So, you’ll have a lot of other money in cash deposits, for example.

Second, and most importantly, when you understand your capacity for risk, you’ll remember to consider the need to protect your capital in other scenarios like:

- Shorter-term, lump-sum investments for growth.

- Investments from which you plan to draw an income or a slice of the capital in the near term – as you will when you come to draw income from an invested pension pot, for example.

K stands for your Knowledge about investing

The last big factor to consider when investing is your knowledge.

And we’ll say, upfront, that we’re concerned to see some #finfluencers on Social Media suggesting that ‘experience’ is more important than knowledge.

Some say that if you don’t have any investing experience, you should just dive in. ‘Feel the fear and do it anyway’ so, to speak.

We strongly disagree with that idea – and believe that a basic knowledge of risk and reward is vital for investors.

What’s more, we’ve known since the 1970s (and the work of Psychologist Albert Bandura on Self-Efficacy) that we’re more inclined to engage in activities in which we feel capable.

With a bit of thought, we can all identify goals (things we want to achieve or improve) in our lives. But converting those dreams into reality can be extremely challenging.

Bandura and others have found that as we become more capable in tasks, we:

- Develop more interest in those activities and commit more strongly to them.

- Recover quickly from setbacks, and see problems as tasks to be mastered.

On the other hand, when we have a low sense of self-efficacy – we may avoid challenging tasks, focus on our personal failings, and lose confidence in our abilities.

So, some sense of capability is vital for engagement in your finances.

Yes, experience can be helpful, but it can also mislead us at the very worst (and best) of times.

For example, many people look to friends or relatives for financial guidance, which may be helpful if those people know enough about personal finance. They should certainly have your best interests at heart.

However, investment guidance from friends and family may be extremely unhelpful if it’s based solely on their ‘experience’ of stellar returns (say 12% a year above inflation!) on the stock market.

If that’s the case, then they and you may be shocked when those markets ‘correct’ and settle into a period of lower, more normal returns. Conversely, those who invested at the top of a market cycle (into technology stocks in the dot.com boom in 1999, perhaps because their friends suggested it!) will have experienced the shock of a severe fall in stock markets.

People with that unfortunate experience may advise you to steer clear of investing at all costs!

We believe everyone should have a basic knowledge of investments and the potential returns (and risks) of investing in different asset types.

Once you understand those basics, you can decide whether the (good or bad) past experiences of others are relevant to your situation – at this point in time.

Ideally, you need this basic knowledge before you start investing.

However, it’s never too late to learn – and it’s always better to learn the concepts in a safe environment like this than through the experience of taking heavy losses in unsuitable investments.

And we hope that this, and the ‘About Money’ articles to follow, help you with that.

A word about valuation extremes

Investment returns vary over different time periods, as those dot.com boom investors discovered in 1999.

So, you need to be aware of any extreme valuations in your chosen investment assets (whether Shares, Bonds, or Property), and this is especially important if your capacity for risk is limited.

To be clear, times of extreme valuations are (normally) quite rare – and may only arise once every twenty or thirty years.

However, from the mid-1990s, across the (developed) world, Central Bank policy (including ‘near-zero’ interest rates since the Global Financial Crisis of 2007-09) has been exceptionally supportive of asset prices.

And this policy has, in large part, driven extreme valuations in certain assets three times in the last 25 years.

You must explore how to respond, if at all, to the rare times of extreme valuation with your financial adviser.

What will you do with these ‘About Money’ articles?

In broad terms, investing does not have to be as complicated as some experts make out.

The essentials are too often lost in jargon and mathematical mumbo jumbo.

In short, if you want (or need) better-than-cash returns on your money, you must accept a degree of risk.

Yes, it’s useful to know your attitude to risk.

However, you may need to adjust your level of risk to account for your capacity for risk in relation to each of your goals.

Unless you’re a sophisticated and experienced investor, a good investment adviser will typically recommend Investing in mainstream, low-cost, collective funds.

These funds hold a diversified basket of shares and other assets quoted on recognised stock markets.

And, over the long term, they’ve produced much higher returns than bank savings – and outpaced inflation, too.

Whether you already have money invested or plan to invest some, we hope you’ll now pay attention to your NACK for investment.

Your need, attitude and capacity for risk.

And your knowledge about risk and return.

And, if you need personal advice on Investing or any other financial planning issue, please contact Create Wealth Management.

Thanks for dropping in.