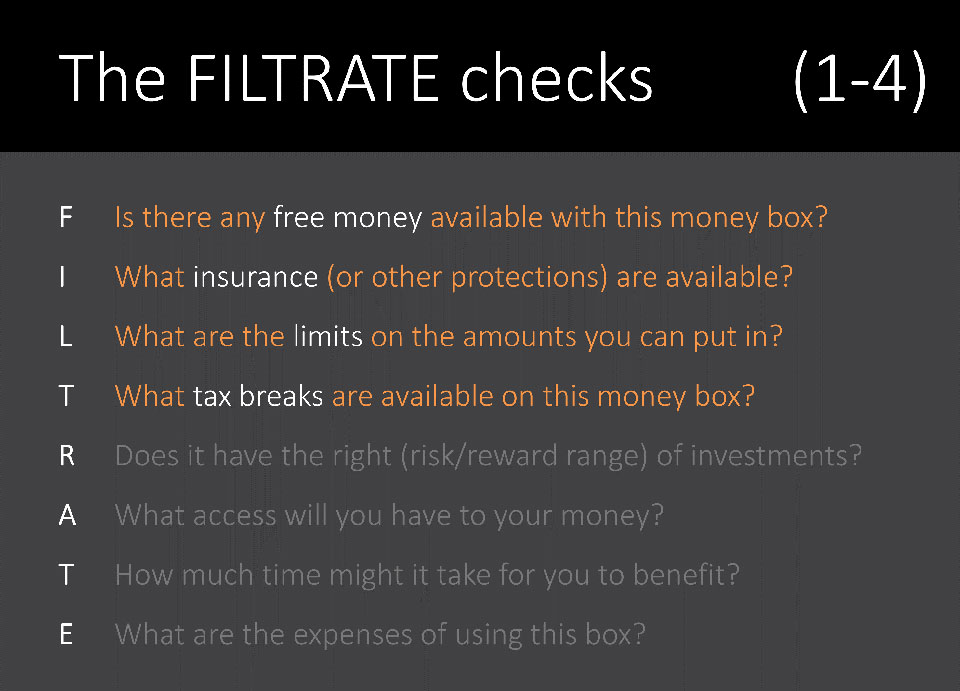

A 10 to 20-minute read – depending on your speed. This is the third of four ‘About Money’ articles on how to choose the right boxes for your money. Our aim in this series is to equip you with an eight-point checklist for assessing any financial product (or strategy) that anyone could ever put to you.

And we’ve designed this checklist to be impossible to forget!

What we’ve covered and what’s coming up

In the first two ‘About Money’ articles, we saw why professionals use checklists in all complex environments and how complex the money box landscape is.

We’ve seen where the task of selecting money boxes fits in the broader process of designing your financial life plan.

We’ve learned why your ideas (about what you want to have, be, or do in the future) should determine the money boxes you need.

We’ve been clear that there’s no such thing as a perfect money box for everyone.

And that it’s our unique circumstances and ambitions that make your (money-box feature) priorities unique to you.

So, you cannot take shortcuts (by copying friends or family members) when choosing financial products.

You need a checklist to consider the pros and cons of your options—and to prevent yourself, your friends, and your family from losing your life savings to scammers.

We also offered guidance on how and when you could use this checklist – and suggested five things you can do if your financial plans are not yet on track.

So, if you’ve not yet done so, please read the first two ‘About Money’ articles before this one.

Now, we’ll start to unpack this eight-point checklist – with examples of how each check could help you choose good boxes for your money.

FILTRATE starts with the letter ‘F’, so that’s where we’ll start!

Check ‘F’: Is there any Free Money available with this money box?

It’s certainly worth asking what free money (or other benefits) are on offer from the Government or your employer to help you with your financial (and personal) wellbeing.

For eligible employees in the UK, your employer must (by law) contribute to your workplace pension, provided that you pay in, too.

Details on eligibility and minimum employer contributions to workplace pensions can be found here.

In short, at minimum levels, the ‘free’ employer contribution adds 60% to the ‘gross’ (before tax relief) amount that you pay in, so that’s a lot of free money for you.

Indeed, many employers offer even more generous matched contribution pension schemes, which, up to certain limits, add 100% to your gross payment. And some employers pay even more than that.

Let’s put this in money terms.

In a matched contribution pension scheme, each £1,000 gross contribution from you (up to a limit defined by each scheme) is matched by a £1,000 employer contribution.

This means that £2,000 goes into your pension pot at a cost of just £800 (or less if you’re a higher-rate taxpayer) from your take-home pay.

(£800 is your personal cost, after 20% tax relief, to make a £1,000 pension contribution)

So, if you’re employed and not already doing so, you may want to consider paying enough into your pension to maximise the amount (of free money) that your employer pays in on top.

Beyond pensions, some larger (private sector) employers also offer various types of Employee Share Incentive Plans. Some plans give you FREE Shares in your employer company, while others give you a discount on the price of shares you can buy through a Save as You Earn account. It’s all effectively free money at your place of work.

And in addition to pensions and share incentive plans, many employers offer one or several of these other employee benefits on top:

- Group life insurance – which pays a tax-free lump sum of money to your named beneficiaries in the event of your death while you’re in that life cover scheme.

- Critical illness insurance – which provides a lump sum if you’re diagnosed with a serious illness.

- Private medical insurance.

- Income protection – to pay a regular income if you’re unable to work for a long period of time – due to ill health or injury.

- Extra holiday allowance.

- Extended paid sick leave.

- Physical and Mental wellbeing support with training, activity and therapy sessions.

- Employee discounts (e.g. on Cinema tickets, holidays, gym memberships and more).

- A Cycle to Work Scheme – with big discounts on the cost of a bicycle and equipment.

- Support for parents, like a workplace nursery and or extended paid parental leave. (Note also, if you’re eligible, you can claim up to £2,000 per child a year from the Government for childcare costs under the tax-free childcare scheme.)

- Extended bereavement leave.

- Various support packages for your professional development.

- Discounted or free food and drinks at your workplace.

Of course, you might say that these benefits are not ‘money boxes’, but if you’re employed, it’s vital to consider the value of these benefits (alongside the pension and any share incentive plans) when weighing up your choices about where to work or whether to go self-employed, for example.

Outside of work, there are two other (widely used) financial products that come with ‘free’ money.

First is the Lifetime Individual Savings Account (LISA), to which the government adds a free bonus of 25% of your contribution – up to certain limits.

Second, and only available to low earners receiving certain state benefits, are ‘Help to Save’ accounts.

These enjoy 50% bonus payments from the Government on savings of up to £50 a month over four years, so the bonus is worth up to £1,200.

In short, you should check what free or discounted benefits you’re entitled to at work or from the government.

Money boxes which come with free money are very hard to beat.

Could you be a free money provider?

So far, we’ve focussed on the free money and other benefits you might receive.

However, if you have more than enough money for your own needs, you could be a provider of free money, in the form of gifts to loved ones or donations to charities, for example.

Research shows that ‘giving’ (things, money, or time) to others can have a big positive effect on our happiness.

What’s more, if your personal wealth is likely to exceed the tax-free (‘nil rate’) bands, then certain gifts you make during your lifetime could substantially reduce the inheritance tax (IHT) on your estate.

And that means you get to leave more money to those you want to receive it.

Check ‘I’: What Insurance or protection is offered?

The ‘I’ check will (hopefully) remind you to explore two areas where you may want insurance (or protections) on your money (or yourself!) against various risks.

First, check if you need any insurance (or insurance policy top-ups) to provide money for loved ones (or yourself) in the event of your death, long-term illness or disability. We’ll expand on the reasons to purchase life and other personal insurance in a future ‘About Money’ article.

For now, think how much money your loved ones would need to (comfortably) cope financially if you were suddenly taken seriously ill or worse.

Think also about how they would gain access to that money – and how long it would take.

Perhaps you already have:

- Life and Income Protection insurance to cover your mortgage?

- Death in service and income protection insurance from your employer to provide any financial dependents with the income they’d need?

- Life and Income protection on your partner if you have one – so you’d be able to cope if the worst were to happen to them?

If not, you should review your insurance needs urgently.

The good news is that (limited term) insurance (and life insurance, in particular) costs much less than most people think.

The cost to provide these insurances depends on the amount of cover and the risk to the insurer of having to pay out.

And with (limited-term) life insurance, if you’re still working and have moderately good health, it’s unlikely that you’ll claim on your policy.

What’s more, the costs are lower still, if you arrange these types of insurance through a qualified adviser.

So, that’s another good reason to take advice.

Very few people think about these personal Insurance policies as valuable money boxes, but that’s what they are.

And, if properly set up, they offer you (and any loved ones who depend on you) immediate peace of mind that, in the event of a disaster to your health (or worse), there’d be enough money available for you or your loved ones to cope.

Another type of life assurance that provides cover for the whole of your life costs much more than limited-term life insurance. This is because (provided you pay your premiums) a whole-of-life policy is guaranteed to pay out.

We all ‘shuffle on from this earth’ eventually, right?

Just be sure to check (with any insurance) that the initial (and any projected increased) premiums will be affordable throughout the period during which you’ll need that cover.

What about investment and pension products?

The ‘I’ check will also remind you to ask whether you’re insured (or protected) against various risks to the money you hold in investment and pension money boxes.

You may not need protections on your investment funds if, for example, you’re many years from retirement and you plan to invest regularly until that time.

However, in some situations, you might want more certainty about what your money box delivers.

For example, by purchasing a pension annuity with some of your pension fund in retirement, you can guarantee a stream of income payments that will be paid for your entire life – regardless of how long you live.

One risk with annuities, however, is that you may leave your loved ones short of money if you don’t choose the right feature options.

So, you’ll want to consider what death benefit guarantees you need on any annuity you purchase to return some of that money to your partner or heirs in the event that you die unexpectedly shortly after that income starts. It’s not expensive to build in those death benefit guarantees.

Conversely, protecting the ‘real’ value of your annuity income from inflation can be very expensive. And you’d need to live for a very long time – for that kind of protection to deliver good value.

To be clear, it’s really quite complicated to work out which pension money boxes to use to provide your income in retirement.

So, professional advice can be extremely valuable in this area.

As for your non-pension investments, the ‘I’ check will remind you to consider what protections you want against:

- Significant changes to interest rates. (a relevant question if you have a mortgage money box, too)

- A long period of inflation that erodes the value of your money.

- Significant falls in the price of investment assets (shares, property or bonds).

The ‘I’ check should also remind you to consider the value of any insured or guaranteed financial products you already hold.

In the past, traditional insurance companies sold hundreds of thousands of pensions and other investment products with guaranteed future fund values or pension income rates. Some of these (future-dated) guarantees apply regardless of changes in stock market prices or interest rates.

So, if you hold such products, you should check the value of those guarantees before you give them up, which you’d typically do if you cashed in that plan or transferred (the value offered to you) to another product provider.

Finally, be aware that some ‘protected’ investment products only protect the value of your money in limited circumstances.

If you’re thinking of investing in plans to protect your money from a market meltdown, check the level of protection you’ll have in that kind of event! The levels of protection offered by these products can be difficult to understand, so seek advice if you’re considering them.

Check ‘L’: Are there limits on what you can put in?

The ‘Limits’ check reminds you to ask about how much (if anything) you’re allowed to put into the money box (or strategy) you’re considering.

Some non-UK nationals (US Citizens, for example) are severely limited on where they can invest their money. And, if you’re a UK national but not currently a UK tax resident, you may also face limits on the money you can put into UK-based tax-advantaged money boxes – like pensions, ISAs and LISAs.

Finally, even if you’re eligible to pay into tax-advantaged money boxes, there are limits on how much you can put in and still enjoy the tax benefits.

The rules around all these limits (particularly with pension contributions) are extremely complicated in some situations, so we’ll not cover them here.

In any event, you can find the details on the websites of the UK Government, Money Helper or most leading financial product providers.

For eligible UK investors, there are two key points to note:

First, the limits mostly affect those seeking to put significant sums into these money boxes.

Second, the limits can be extremely tricky to navigate without tripping over another tax trap.

So, seek professional advice if you’re unsure of your eligibility to pay into these UK tax-advantaged money boxes or if you fear you’ll exceed the contribution limits.

And take advice if you’re thinking of transferring existing pension benefits from one scheme to another, especially if you’ll be giving up valuable guarantees in the process.

Some Defined Benefit pension schemes won’t normally allow transfers out unless you’ve taken professional advice.

And some (public service) schemes will only offer pension benefit transfers to other public service schemes.

When your age is more than a number.

Note also that some money boxes limit eligibility by a minimum or maximum age.

For example, you must be 18 or over but under age 40 to open a Lifetime ISA (LISA), and even then, you can only pay into this product until your 50th birthday.

So, if you’re approaching 40 and believe the LISA money box may be useful to you at some point, it might make sense to open one of those accounts, if only with a nominal amount.

With pensions, as ever, the rules are more complicated.

Curiously, you can set up (and pay into) a pension plan for another person from the day they are born!

However, just because this is possible does not necessarily make it the best way to help a child start building some wealth.

The right thing to do depends on their (and your) circumstances, and your objectives for that money.

There are various ways to save for children, so we’ll return to this topic in the future.

In terms of your own pension savings, you need to be:

- Aged 16 or more to opt into an employer’s workplace pension scheme.

- Aged 18 or more to start your own personal pension.

- Under age 75 to keep paying into a pension – and enjoy tax relief.

Property investing has very different limits.

The limits check will also remind you to think about how much money you need to get started with various money boxes or strategies.

For example, you can start building wealth in various investing money boxes (like ISAs, LISAs and Pensions) with just a few pounds each month.

By contrast, if you want to focus on building wealth through buy-to-let property investing, you’d need a great deal more money (for the mortgage deposit, stamp duty, legal and other set-up costs) before you can get started.

What’s more, with mortgaged property investment, you’ll need to consider ‘gearing risk’, which we’ll cover in the next ‘About Money’ article.

Check ‘T’: What are the tax advantages?

The first ‘T’ check in our FILTRATE checklist should remind you to ask what tax, if any, you could save with the money box or strategy you’re considering.

Taxation is an enormous subject, so we can only touch on it here.

However, you can open up some extremely valuable conversations about tax efficiency simply by asking these four questions:

Q1: Are there any upfront tax advantages?

Ask if there are any tax advantages (on income or capital taxes) when you place money (or transfer other investments) into the money box you’re considering.

For example, with pensions, you’ll normally enjoy income tax relief on the money you pay in.

Currently, that tax relief applies at your marginal tax rate, which, in some cases, can generate an enormous uplift (of 100% or more) on the personal cost of your pension contribution.

By contrast, money put into individual savings accounts (ISAs) does not qualify for upfront tax relief.

hat said, as noted earlier, up to certain contribution limits, the Government adds a 25% free bonus to your savings in a Lifetime ISA.

And that 25% bonus gives the same uplift effect on your input as basic rate tax relief on a pension.

An £800 net pension contribution creates a £1000 pension input.

And £1,000/£800 = 125%

Q2: Are there any ongoing tax advantages?

How will your money be taxed (on an ongoing basis) while it’s held inside the money box you’re considering?

The answer, on both Pensions and ISAs, for example, is that the income (typically dividends and interest) and gains on your funds grow virtually tax-free.

Q3: Are there tax advantages when you take your money out?

What tax will be payable when you withdraw some or all of your money from this money box? (Or, in the case of a directly held asset, like an investment property, what tax might you pay when you sell the asset completely?)

With ISAs (and Lifetime ISAs used for first home purchase or retirement from age 60), your personal withdrawals are completely tax-free.

With pensions, only part (typically 25%) of the pension pot can be withdrawn tax-free. The rest of the pension pot, whether taken as income or in one lump sum, is normally subject to income tax.

That said, with careful planning (and depending on your other income when you take money out of your pension), you may be able to legitimately reduce or avoid tax on the taxable portion.

On residential buy-to-let type (not your main home) properties, you may have to pay Capital Gains Tax (CGT) if you make a profit (‘gain’ after certain deductions) when you sell (or ‘dispose of’) that property.

Note also that CGT is payable even if you give property away to another person—unless that gift is to your spouse or civil partner, and you live together.

So, watch out for that tax trap.

Many people are shocked to learn that they must pay CGT on a gain after giving a property away.

Q4: Are there any Inheritance Tax (IHT) advantages.

This question may only be of interest to the relatively small number of people whose (IHT taxable) estate will be big enough for this tax to be a problem.

However, the numbers affected by IHT have grown rapidly in recent years – because the main IHT tax-free (nil rate) band has not been increased since 2009.

What’s more, this tax-free band (and the additional Residence Nil Rate Band) is now set to stay frozen until April 2030.

So, unless this tax is abolished (or the rules change significantly), we might expect a lot more people to get caught by it in the future.

The detailed operation of Inheritance Tax is well beyond the scope of this ‘About Money’ article. Just be aware that on estates which pay IHT, it’s quite common (if no planning is done) for the taxman to take more than is left to each beneficiary!

There are various actions you can take to reduce or eliminate this tax if you’re concerned about it. Indeed, there are so many legitimate ways to avoid this tax that Roy Jenkins, Chancellor of the Exchequer for the Labour Government of the late 1960s, said,

“Inheritance tax is a voluntary levy, paid by those who distrust their heirs more than they dislike the Inland Revenue!”

And the truth of that witty remark still applies today.

If IHT is something you’re worried about, explore your estate planning options early and take advice from someone competent in this complex area.

Failing to plan (or poor-quality estate planning) can cost a lot more than money; it can result in severe family relationship problems, too.

How does IHT apply to some basic money boxes?

Most people are surprised to learn that (so-called) tax-free ISAs are not tax-free at all when it comes to Inheritance Tax.

Depending on your total (IHT taxable) wealth, this tax could take away as much as 40% of your ISA fund.

No, that’s not a typo. 40% of your entire ISA plan value may be lost to IHT in some cases.

IHT is a tax on the value of your taxable estate – above certain nil rate bands. It’s not a tax on the profits you’ve made over time; that’s CGT, and there’s no CGT on ISAs or, currently, on death.

So, if the full value of a £500,000 ISA pot were subject to IHT after your death, the tax man would take £200,000 from that pot alone!

Most pension funds, on the other hand, currently pass Inheritance Tax-Free to your nominated beneficiaries when you die – but this situation is due to change in April 2027, and the planning implications are complex.

If you wish to avoid paying unnecessary amounts of IHT, please get in touch.

Tax section summary

Government-approved ISAs and Pensions have tax advantages, but there are tripwires and tax penalties for the unwary if you’re wealthy or you exceed the input limits.

ISAs are not tax-free when it comes to Inheritance Tax.

If you’ve already invested your input-limited amounts to mainstream tax-advantaged money boxes, there are other products you could consider for sheltering your wealth from some of the taxes you’d otherwise pay.

The workings of those other products are beyond the scope of this series, but you can use this FILTRATE checklist to explore those other tax-saving options.

Note also that there are no tax advantages to holding residential property in your personal name. And there are some tax disadvantages to doing so.

Holding property within a company structure can have advantages, but the details of that strategy are, again, beyond the scope of this series.

What we hope is clear is that there’s a lot to consider around the taxation of your money boxes.

So, please make these checks with the help of a competent adviser.

Coming Next

In the next and final ‘About Money’ article in this series, we’ll outline the last four (of our eight FILTRATE) factors to consider when looking for the right boxes for your money.

See you in there when you’re ready for that.

Thanks for dropping in.