A 5 to 10-minute read – depending on your speed. This is the second of four ‘About Money’ articles on how to choose the right boxes for your money.

In this series, we’ll equip you with an eight-point checklist for assessing any financial product (or strategy) that anyone could ever put to you.

And we believe this is a checklist you’ll never want to forget.

Where we’ve been and what’s ahead

In the first ‘About Money’ article, we saw why a solid checklist is essential for deciding between the overwhelming choice of money boxes and strategies available.

We also explained how this money-box-selection task is just part (and not the start) of the financial planning process.

To design a good financial plan, you start with ideas about your personal life goals. It’s what you want to have, become, or do – the things that really matter to you – which will determine the money boxes you need.

So, if you’ve not yet done so, read that first ‘About Money’ article before this one.

In the next two ‘About Money’ articles, we’ll dig into the details of our eight-point checklist with examples of how each check can help you choose the right boxes for your money.

First, in this ‘About Money’ article, we’ll outline the checklist and offer you guidance on how best to use it. Remember that tens of thousands of people (worldwide) lose their life savings to scammers and fraudsters every year. So, a sound checklist could save your financial life, or those of your friends and family, if you share this series with them.

Now, let’s get into this.

A checklist you’ll never forget

There’s no priority order for using our eight ‘FILTRATE’ checks.

They’re only in this order to help you recall them when:

- You next need to decide on which money box to use.

- You talk about money matters with friends and family.

If you can remember the word ‘Filtrate’, you can remember this checklist. You might not remember the details, but you’ll remember there are eight (filtrate) checks and, hopefully, where to find the checklist when you need it.

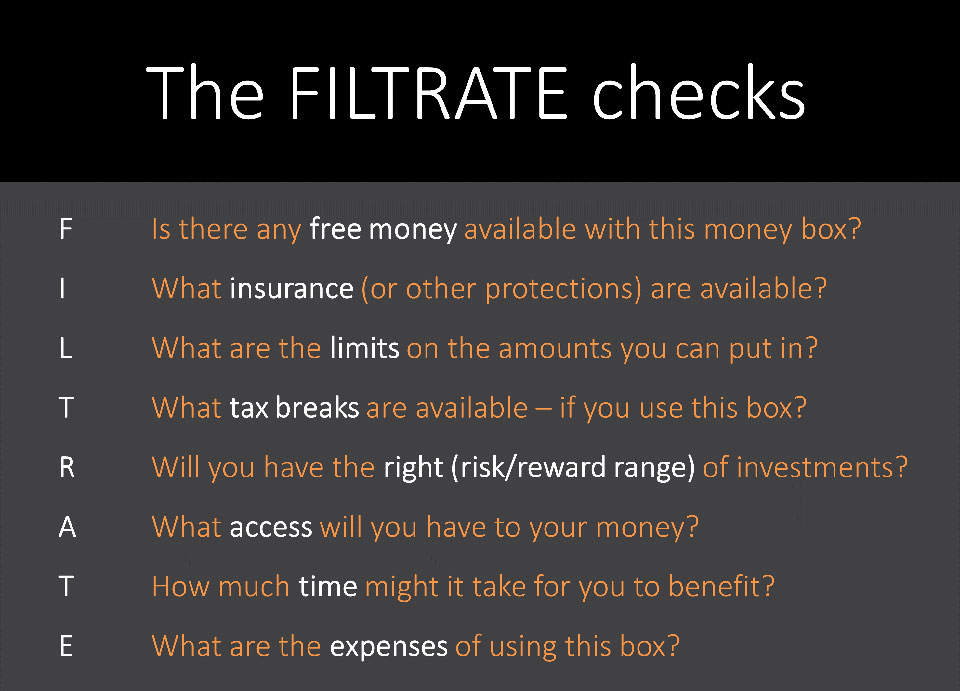

The keyword for each of our eight checks begins with one of the letters in FILTRATE – which fits perfectly with the aim of finding good homes for your money and filtering out the rubbish.

Here, in outline, are the eight filtrate questions to ask about any money box (or strategy) that anyone could ever put to you.

In the next two ‘About Money’ articles, we’ll unpack the details of those checks, but first, here’s some guidance on how to use them.

1. There is no priority order for these checks.

As you go through life, your financial life goals will change, so your priority money box features will change, too.

What’s more, the moneybox features that matter most to you will be different to others (even if they’re a similar age to you) because your financial circumstances, attitudes and ambitions are completely unique to you. Few people really understand this point, but it’s essential to remember when discussing financial strategies with friends and relatives.

It’s easy to fall into the trap of thinking that what’s right for others must be right for you, but that’s seldom true. The clue to the value of personal financial planning is in the name – it’s personal.

For example, most people (including some influential money experts) will tell you it’s a ‘no-brainer’ to save into a pension for your later years.

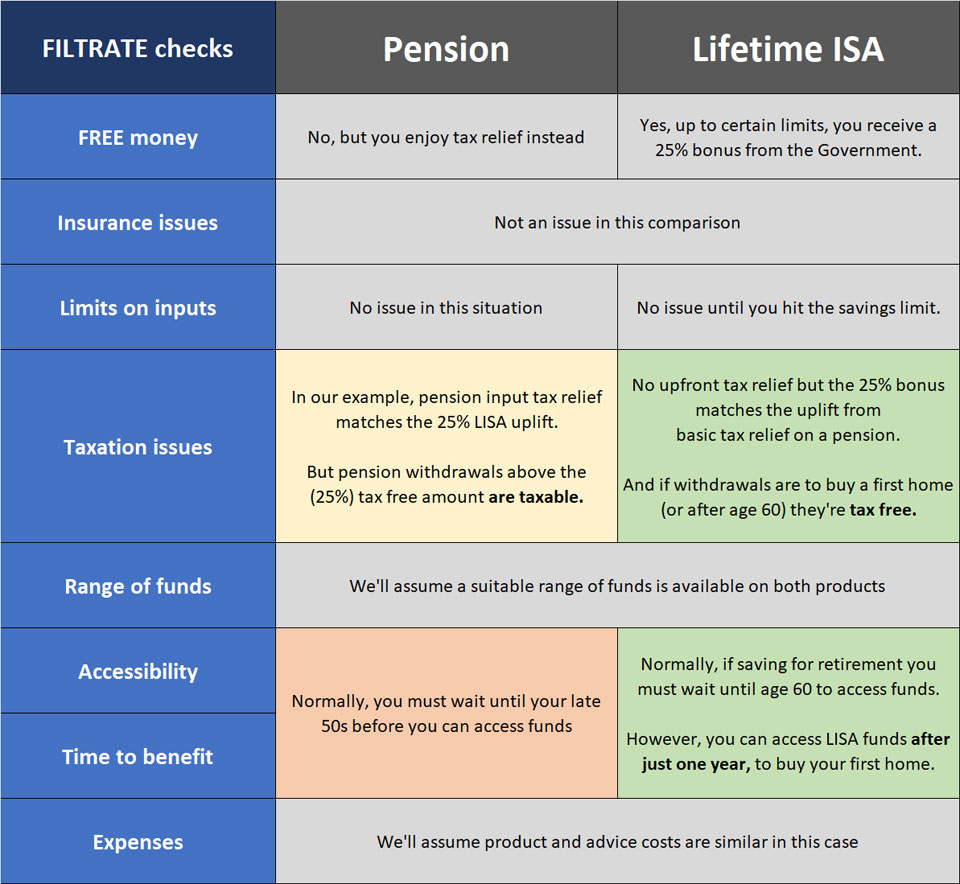

But let’s consider someone in their 20s who is self-employed, rents a flat, wants to buy a home, and can afford to save about £250 per month. Let’s compare the no-brainer pension advice they’ve been given against a Lifetime ISA using our FILTRATE test.

You’ll notice that some comparisons of money boxes (like this one) can be quite simple. To inform your decision, you only need to focus on a few factors (of the eight in our checklist).

2. Don’t expect to find the perfect money box.

Please don’t expect to find a money box or strategy with high scores on all eight factors in our checklist.

We can’t think of any that do.

For example, you might not like the idea of not having access to your money in a pension plan until your mid to late 50s. However, if you’re able to pay into a workplace pension, you may conclude it’s hard to beat when you consider that you’ll receive:

- ‘Free money’ from your employer’s contributions

- A tax saving on your contributions.

So, unless you can afford to put money into every possible type of money box, you’ll need to choose between the available options.

And the best decisions are those based on the factors that matter most to you – personally.

3. You may need help to quantify some benefits.

To make good money box decisions, you’ll want to know how much you could benefit (or lose) on each of the filtrate factors.

Some factors (like knowing you can access your money at short notice) are not quantifiable in £ terms – and you may need expert help to nail down the numbers on those that are.

For example, it sounds nice to enjoy (basic rate) 20% tax relief on your pension input. After all, that equates to a 25% uplift on your (net of tax) contribution. An £800 cost to you puts £1,000 in your pension pot right away.

And, if you’re employed and can join a generous workplace pension scheme, then regardless of whether you pay tax at higher or basic rates, the free money from your employer will make the pension option for retirement savings very hard to beat.

That said, as we’ve seen, up to certain limits, you get a 25% uplift (free bonus) on the money you put into a Lifetime ISA.

So, that product may be a good place to start saving if you’re young, self-employed (with no employer putting money into your pension), you pay tax at basic rates, and you’ve not yet bought (but plan to buy) a first home.

Of course, if you’re self-employed and earning enough to pay higher rates of tax – the numbers are different. In this case, the uplift on your net cost of paying into a pension could be between 67% and 150%…

Or, in some situations, even higher!

So, as you can see, if you run your own business or pay taxes at higher rates, it can pay to take advice and get these numbers right.

4. When is a good time to use this checklist?

Ideally, you’ll check that a money box is right for you before you put any money into it.

And anyone who’s been caught out in an investment scam – including those famous people who lost fortunes in Bernie Madoff’s Ponzi scheme, would agree with that.

So, it’s essential to use a solid checklist with investments where there’s a risk of a permanent loss, and especially where the returns look too good to be true, as they did with Madoff’s Scheme.

However, you can also use these checks to see if any financial products you already hold are still suitable for you. Don’t worry if you feel you’ve made bad choices in the past; few people make great money box choices the first time around.

The important thing is to avoid getting stuck in a poor-quality money box – because sticking with an excessively risky or costly product could cost you thousands (or tens of thousands) of pounds over time.

And, even if your product choices were perfect when you made them, various things may have changed to make a review worthwhile.

- Your circumstances and/or life goals will change, or you may change jobs and become eligible for different savings, pensions, and insurance products.

- The Government may introduce a new financial product or change the tax rules on existing financial products. And these changes could boost or reduce the attraction of some products versus others.

- The market for financial products is competitive. So, new (or enhanced) products are launched quite regularly, and some of those products may be more suitable for you than the product(s) you hold today.

Whatever the reason, it makes sense to occasionally check that you have the right boxes for your money.

5. Don’t worry if your finances are not yet on track

Please remember that very few people have their money perfectly organised and planned. So if, like most people, your financial goals are not yet on track, you have five ways (or a mix of these ways) to fix that. You could:

- Make smarter money box choices – and the checklist we’re exploring here will help you with that.

- Save more towards your life goals – if you have scope to cut out some wasteful spending or earn more income.

- Trim back your ambitions – on the amount you plan to spend on a particular goal.

- If you have the option, delay the target date for one (or more) of your goals. (This is not an option if you are saving to help a child through university!)

- Remove a discretionary goal from your goals list – for now. You can always add it back onto your list when your financial position improves.

We’ll focus on the first option, making smarter money box choices, as we examine the details of these eight FILTRATE checks.

See in the next ‘About Money’ article when you’re ready for that, or ask Create Wealth Management to do this analysis for you.

Thanks for dropping in.